Advertisement|Remove ads.

Is IRFC Bottoming Out? SEBI RA Flags Accumulation Zone Near ₹127–₹129 Ahead Of Q1 Earnings

Indian Railway Finance Corporation (IRFC) shares have declined 41% from their all-time high of ₹225, reached in July 2024. Technical charts indicate that it has tested its key support zones and is currently in a consolidation phase.

But is the railway PSU giant gearing up for a rebound as it prepares to report its first quarter earnings on July 22? SEBI-registered analyst Rohit Mehta noted that the stock was forming a potential base around ₹129–₹ 127 after a prolonged correction.

If it reclaimed ₹154, it could signal a reversal attempt. Current volumes suggest accumulation at lower levels, he said.

On its technical charts, he identified resistance levels at ₹154, ₹186, and ₹225 for IRFC, with support zones at ₹129–₹127, followed by ₹114–₹111.

Based on its shareholder trends, promoter holdings increased from 83.36% in December 2024 to 86.36% in March 2025. Meanwhile, Foreign Institutional Investors (FIIs) decreased marginally from 1.01% to 0.98%. Domestic Institutional Investors (DIIs) increased holdings from 1.24% to 1.34% over the same period.

For the quarter ending March 2025, IRFC reported a year-on-year (YoY) sales increase of 3.83% and a 3.70% rise in operating profit. However, it showed a decline in profit before tax (PBT) by 2.04%, and earnings per share (EPS) decreased by 1.53% YoY.

Mehta highlighted that the company has consistently maintained a healthy dividend payout ratio of 26.2%.

However, on the other hand, the stock is currently trading at 3.32 times its book value, which may indicate overvaluation. Additionally, its interest coverage ratio is low, suggesting a limited buffer for debt servicing.

Mehta also stated that the effective tax rate appears to be lower than the standard corporate rate. There is also a possibility that the company is capitalizing interest costs, which could impact its reported profits.

The company has delivered a modest return on equity of 13.6% over the past 3 years.

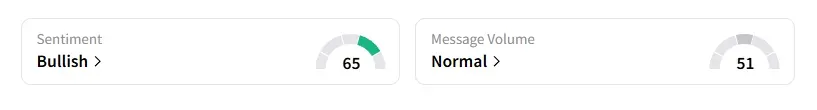

Data on Stocktwits shows that retail sentiment has been ‘bullish’ on this counter.

IRFC shares have declined 9% year-to-date (YTD).

For updates and corrections, email newsroom[at]stocktwits[dot]com.

/filters:format(webp)https://news.stocktwits-cdn.com/Getty_Images_2218096416_jpg_9d469a2ec6.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/jaiveer_jpg_280ad67f36.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/large_sealsq_stock_market_representative_resized_b05435011f.jpg)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/unnamed_jpg_9dff551b50.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Getty_Images_2229019640_jpg_c6006d7238.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/large_adam_smigielski_K5m_Pt_O_Nmp_HM_unsplash_f365ee93f4.jpg)

/filters:format(webp)https://news.stocktwits-cdn.com/large_trump_jpg_fc59d30bbe.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Aashika_Suresh_Profile_Picture_jpg_2acd6f446c.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_1190665957_jpg_92088206ed.webp)