Advertisement|Remove ads.

Is Kennedy-Wilson Stock Set To Rally? Buyout Proposal From CEO, Fairfax Turns Investor Heads

- Kennedy-Wilson’s CEO and Fairfax Financial submit a bid to acquire the real estate company at $10.25 per share, a 37% premium over its last close.

- Kennedy-Wilson has formed a special board committee to review the proposal.

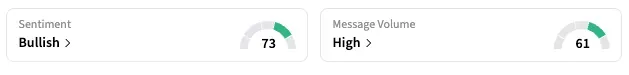

- The company’s stock gained over 28% in Tuesday’s after-market session, with Stocktwits sentiment shifting to ‘bullish.’

Kennedy-Wilson Holdings, Inc.’s shares will be in focus on Wednesday, after their sharp rally in the after-market session following the company’s disclosure of a buyout proposal from its Chairman and CEO, William McMorrow, and Fairfax Financial Holdings Ltd.

McMorrow and the Canadian insurer have proposed to acquire the remaining shares of Kennedy-Wilson that they do not already own for $10.25 per share, the company said in a Tuesday exchange filing. The non-binding offer represents a premium of more than 37% over Kennedy-Wilson’s closing price that day.

Kennedy-Wilson said it has formed a special board committee to review the proposal.

Shares of the company jumped 28.5% to $9.60 in Tuesday’s after-market session, coming in as the fifth biggest gainer among U.S. equities. On Stocktwits, the retail sentiment for KW shifted to ‘bullish’ as of early Wednesday, up from ‘neutral’ the previous day.

Beverly Hills, California-based Kennedy-Wilson is a real estate company that buys, builds, and manages apartment buildings and office spaces, mainly in the U.S., UK, and Ireland. It recently bought Toll Brothers’ apartment business for $347 million.

The development significant weakness for the company’s shares and a gloomy outlook from analysts. As of the last close, KW stock has declined by over 25% year-to-date; two of the three analysts covering it recommend ‘Hold,’ and one rates it a ‘Strong Sell,’ according to Koyfin.

For updates and corrections, email newsroom[at]stocktwits[dot]com.

Read Next: Studio Ghibli, Other Japanese Creators Urge OpenAI To Stop Using Their Content For Sora 2

/filters:format(webp)https://news.stocktwits-cdn.com/large_Intuit_resized_jpg_913ef93c15.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/IMG_9209_1_d9c1acde92.jpeg)

/filters:format(webp)https://news.stocktwits-cdn.com/large_oil_rig_bfbf070c8b.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/IMG_8805_JPG_6768aaedc3.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_bitcoin_with_others_OG_jpg_86ee42eaf9.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Anushka_Basu_make_me_smile_in_the_picture_b92832aa_af59_4141_aacc_4180d2241ba8_1_2_png_1086e0ed8c.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_micahel_saylor_OG_3_jpg_4f304c479d.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_1473343393_1_jpg_536dff4c41.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2247675651_jpg_f78879cce2.webp)