Advertisement|Remove ads.

Is Ola Electric Turning A Corner? SEBI RAs Weigh In On Q1 Tailwinds, Price Risk

Ola Electric shares have been in a downtrend, falling over 50% this year. But according to an advisory firm, it may be entering a new phase of recovery, driven by improving margins and an optimistic management outlook.

SEBI-registered advisor Cashvisory India noted that Ola Electric may be turning a corner, with several operational improvements setting the tone for upcoming quarters.

Ola shared a revenue guidance of ₹800–850 crore in its first quarter (Q1FY26), a robust 35% gain quarter-on-quarter (QoQ), backed by 65,000 deliveries and gross margin projection of 28–30% compared to 20.5% in FY25.

Additionally, its auto segment turned EBITDA positive in June for the first time, with net losses shrinking to ₹428 crore from ₹563 crore (QoQ).

The company has ramped up its Gen 3 platform, achieving a 58% attach rate for MoveOS+, which both contribute to margin expansion. It has also begun rolling out the Roadster, which is seeing strong demand in rural areas, especially in Uttar Pradesh.

They have also identified some weaknesses that Ola has faced, including regulatory issues that affected Q4, resulting in a decline in market share over the past two quarters. Delays in its cell project have led to hurdles in ramping up yield. The company is not yet profitable at a net level, so certain financial risks remain.

On the investment front, they believe that Ola’s improving operations, steady margins, and disciplined capital expenditure provide support. While its FY26 margin target looks ambitious, given the recent momentum, it may not be impossible to achieve, they added.

However, Mayank Singh Chandel shared a cautious outlook on the stock. Ola Electric is in a long-term downtrend, so fresh entry should be avoided, according to him. If you're already holding, he suggested setting a stop-loss below ₹39.58 and a potential target around ₹ 53.30.

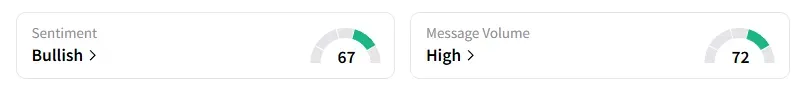

However, data on Stocktwits shows that retail sentiment has been ‘bullish’ on this counter for a week.

For updates and corrections, email newsroom[at]stocktwits[dot]com.

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2264020227_jpg_4d7420bef3.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Anushka_Basu_make_me_smile_in_the_picture_b92832aa_af59_4141_aacc_4180d2241ba8_1_2_png_1086e0ed8c.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2259210190_jpg_d48bbe3269.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_1396534113_jpg_b0e09f299b.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Jane_Street_3ac3fb6443.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Truth_social_5bfbc7389b.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2221283194_jpg_8178c730a4.webp)