Advertisement|Remove ads.

Is The Fed About To Blink? Here’s How Retail Traders Are Playing It As Powell’s Jackson Hole Talk Fuels September Rate-Cut Hype

Federal Reserve President Jerome Powell delivered what investors and a section of economists and policymakers wanted to hear in his Jackson Hole speech on Monday. Although he laced his comments with caution, the market interpreted them as a confirmation that a rate cut could be announced at the September 16-17 Federal Open Market Committee (FOMC) meeting.

The SPDR S&P 500 ETF (SPY), an exchange-traded fund (ETF) that tracks the S&P 500 Index, climbed 1.54% on Friday, and the Invesco QQQ Trust (QQQ) ETF snapped a six-session losing streak, also ending 1.54% higher.

The SPY and QQQ ETFs are up 10.76% and 12.17%, respectively, for the year.

On Stocktwits, retail sentiment toward the SPY ETF remained ‘bullish’ (67/100) by late Sunday, accompanied by ‘normal’ message volume. The QQQ ETF attracted only ‘neutral’ (49/100) and the message volume was ‘normal.’

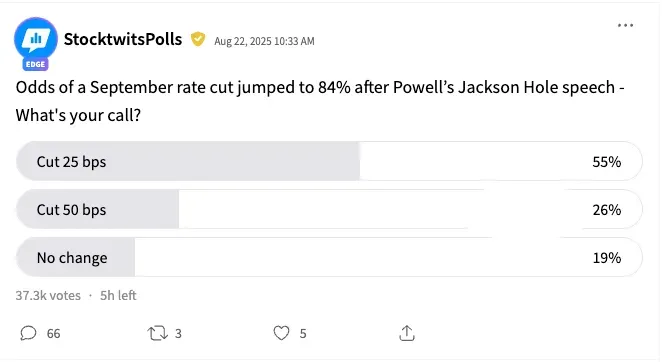

Following Powell’s Jackson Hole address, we asked Stocktwits users, “Odds of a September rate cut jumped to 84% after Powell’s Jackson Hole speech - What's your call?”

The poll, which ends in a few hours, has received responses from 37,200 users. A majority (55%) braced for a 25 basis point (bps) cut, 26% expected a 50 bps reduction, and 19% prepared for the central bank holding fire.

A user said Powell will cut rates by 25 bps, but it would make sense to reduce them by a steeper 50 bps. A few also warned against a rate cut, citing inflation.

Another user deemed it best to be cautious. “I won't frontrun Powell. The Fed has a history of saying one thing and doing another.”

According to the CME FedWatch Tool, which factors in expectations of futures traders, the odds of a 25 bps cut are now at 87.3%.

If the Fed does drop rates, it would prove healthy for stocks, according to historical data shared by Carson Group’s Ryan Detrick. “When the Fed cuts rates within 2% of all-time highs, the S&P 500 loves it,” the strategist said, adding that “In 20 of the last 20 times this has happened: The S&P 500 has risen an average of +13.9% over the following 12 months, per Carson Research.”

For updates and corrections, email newsroom[at]stocktwits[dot]com.

Read Next: Tim Cook Completes 14 Years As Apple CEO — Here’s How The Stock Has Risen On His Watch

/filters:format(webp)https://news.stocktwits-cdn.com/large_nio_jpg_4ad189441e.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/IMG_8805_JPG_6768aaedc3.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2259503553_jpg_13fb8f2e88.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/IMG_9209_1_d9c1acde92.jpeg)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/large_trader_stock_chart_resized_861d098b1f.jpg)

/filters:format(webp)https://news.stocktwits-cdn.com/IMG_4530_jpeg_a09abb56e6.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/large_US_stocks_3e2253bcca.jpg)

/filters:format(webp)https://news.stocktwits-cdn.com/Revised_Profile_JPG_0e0afdf5e2.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_122032465_jpg_9592f3bcfd.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/large_Novavax_building_93bfe3bf8c.jpeg)