Advertisement|Remove ads.

Tim Cook Completes 14 Years As Apple CEO — Here’s How The Stock Has Risen On His Watch

Apple Inc. (AAPL) CEO Tim Cook has completed nearly a decade and a half as the company’s CEO. Although he has often been criticized for a lack of breakthrough innovation and creativity — something that his predecessor, Steve Jobs, excelled in — his tenure has proven healthy for his investors.

Cook took over as Apple’s CEO on Aug. 24, 2011, after the company’s iconic co-founder passed on the baton less than two months before he passed away due to pancreatic cancer.

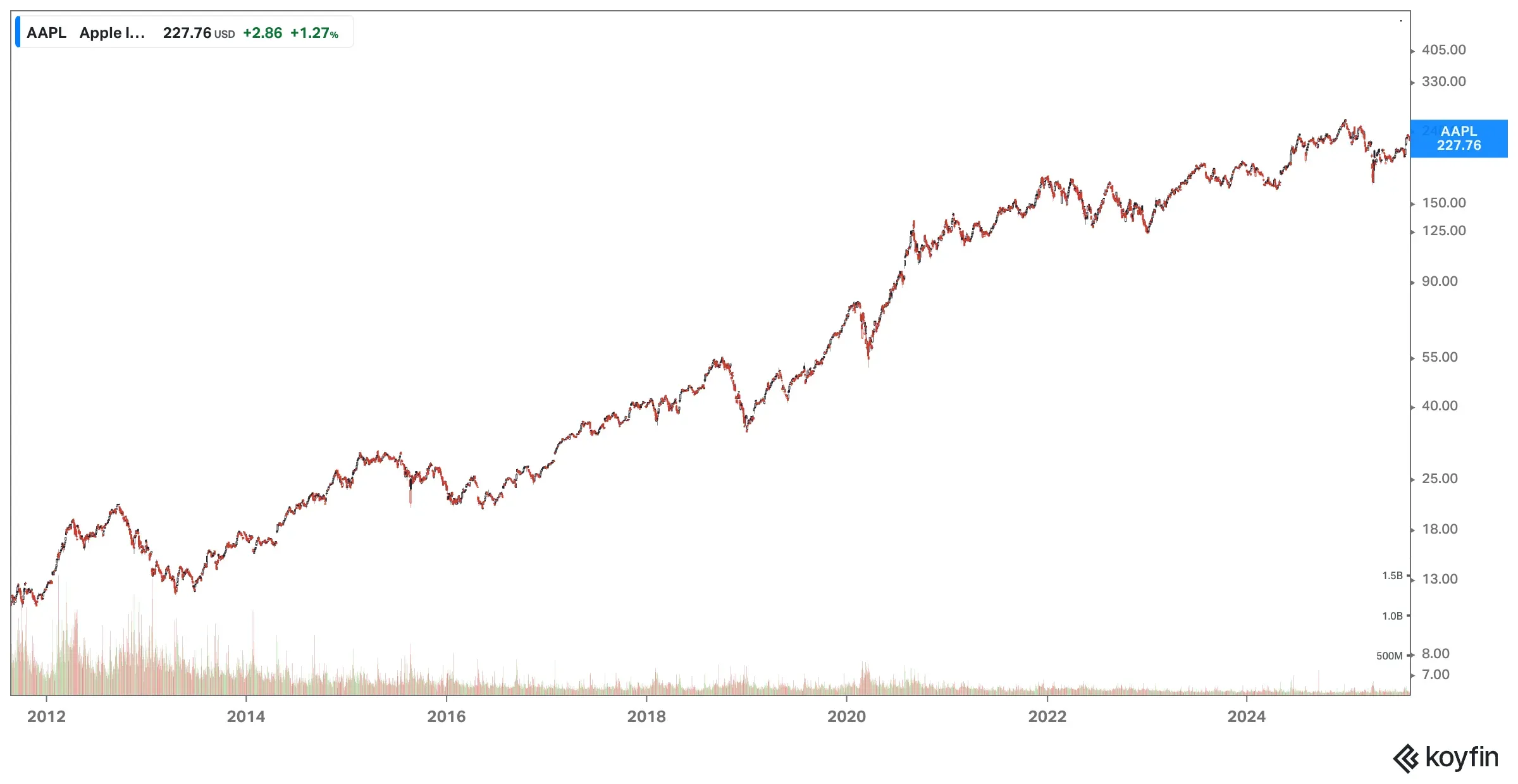

Since Cook assumed 1,809% returns, not counting the dividend income. His predecessor Jobs opposed any dividend payments and paused the policy after he returned as CEO in 1997.

It was only after Cook took over that the company announced plans to reinitiate dividend payments and stock buybacks.

Chart courtesy of Koyfin

Chart courtesy of Koyfin

To put things in perspective, a $1,000 investment in Apple stock when Cook took over would be worth $2.6 million now.

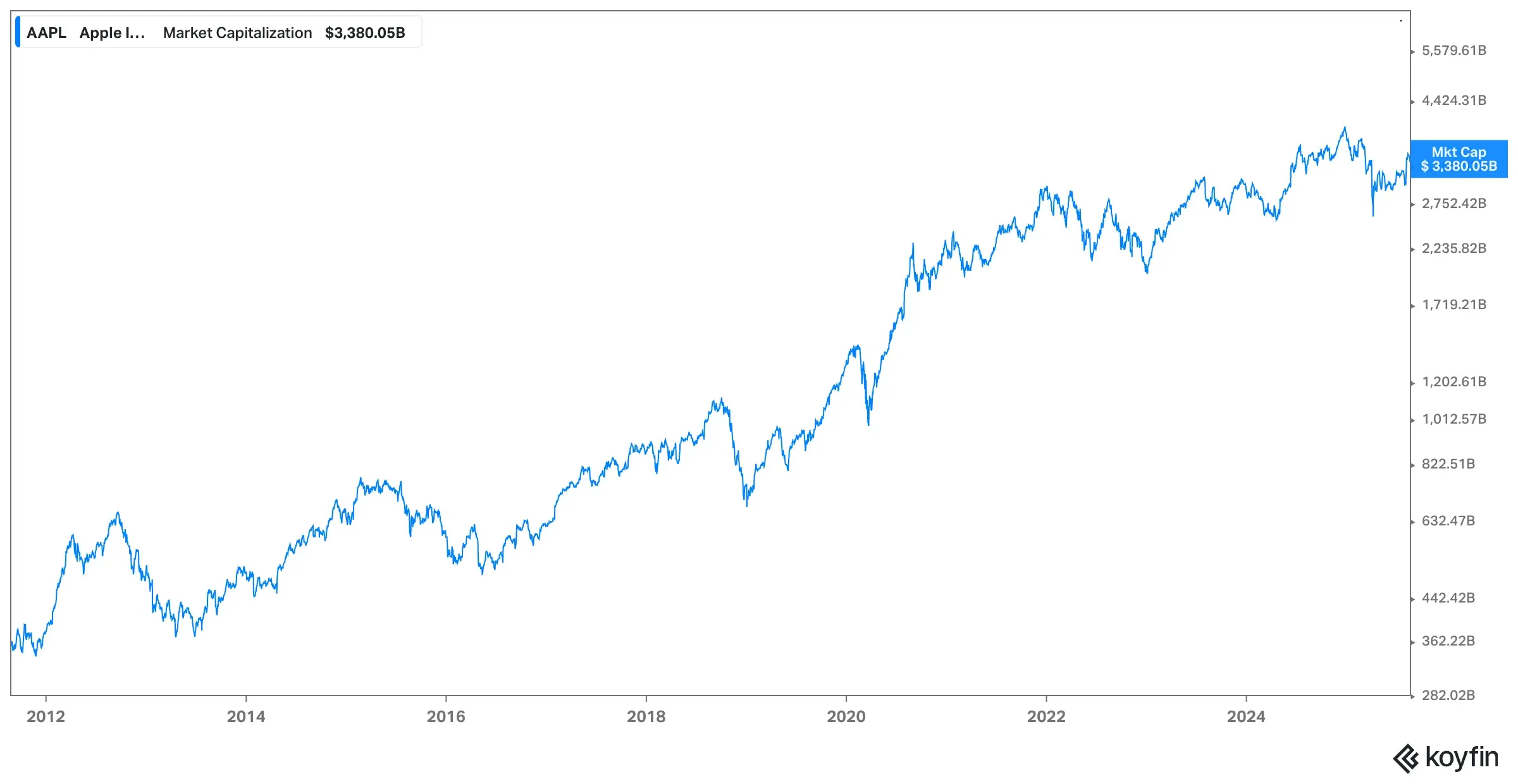

The company’s market cap has grown to $3.38 trillion, based on the last closing price, from under $350 billion when Cook took over.

Chart courtesy of Koyfin

Chart courtesy of Koyfin

The $1 trillion market-cap was first hit in Aug. 2018, the $2 trillion in Aug. 2020 and in June 2025.

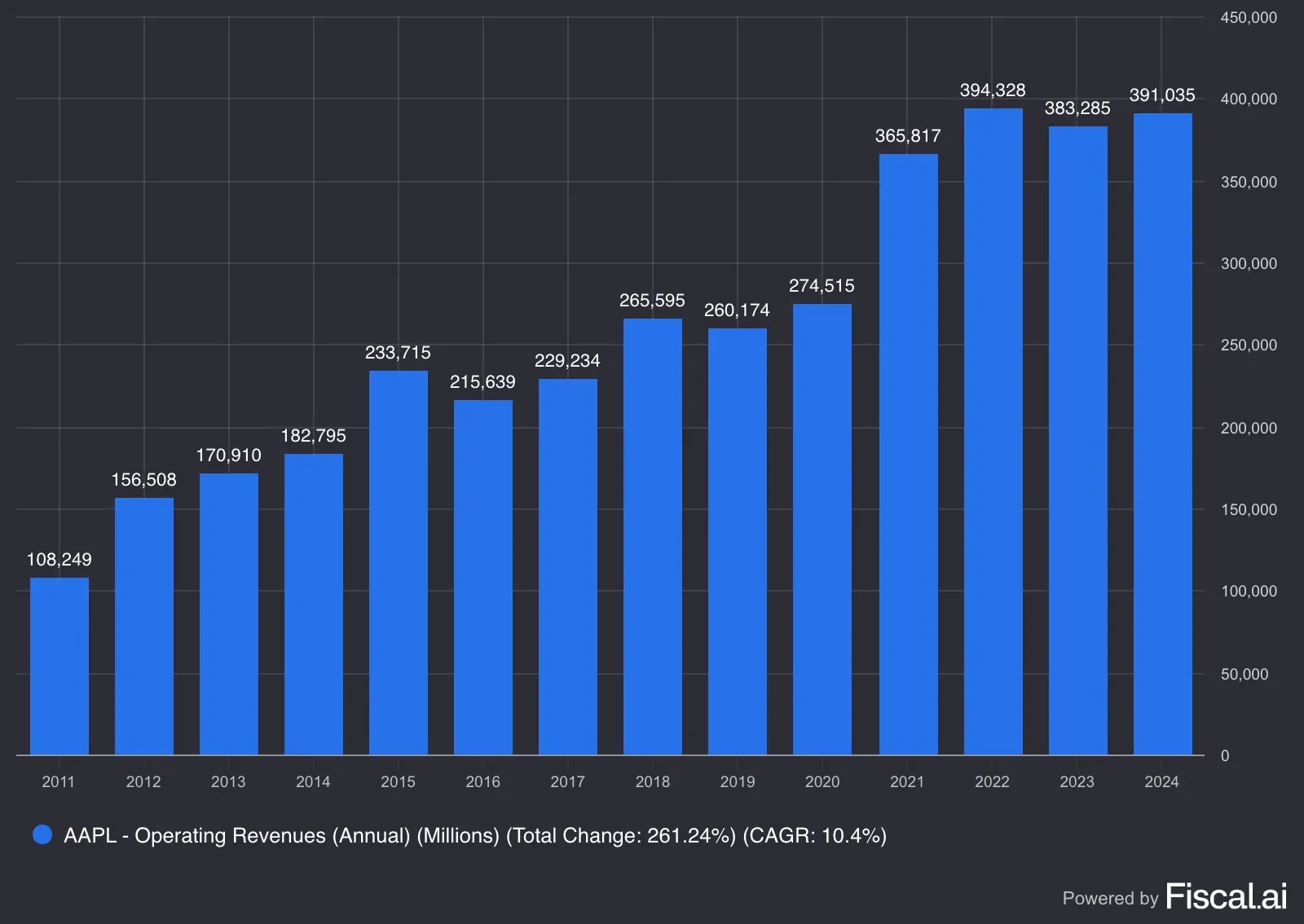

Apple’s revenue has grown to $391,035 billion for the fiscal year 2024 that ended on Sept. 28, 2024, from $108.25 billion in 2011.

Chart courtesy of Fiscal.ai

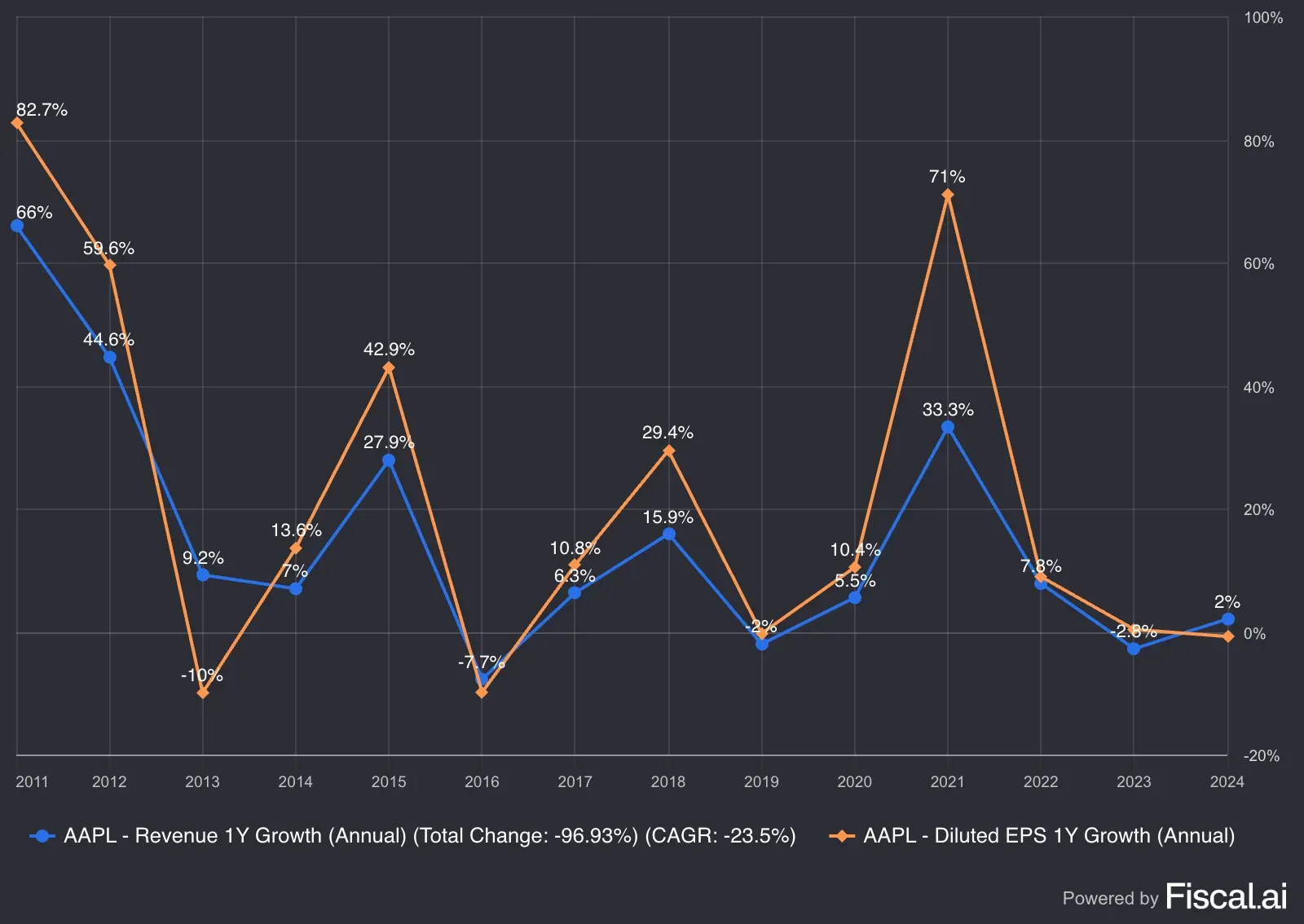

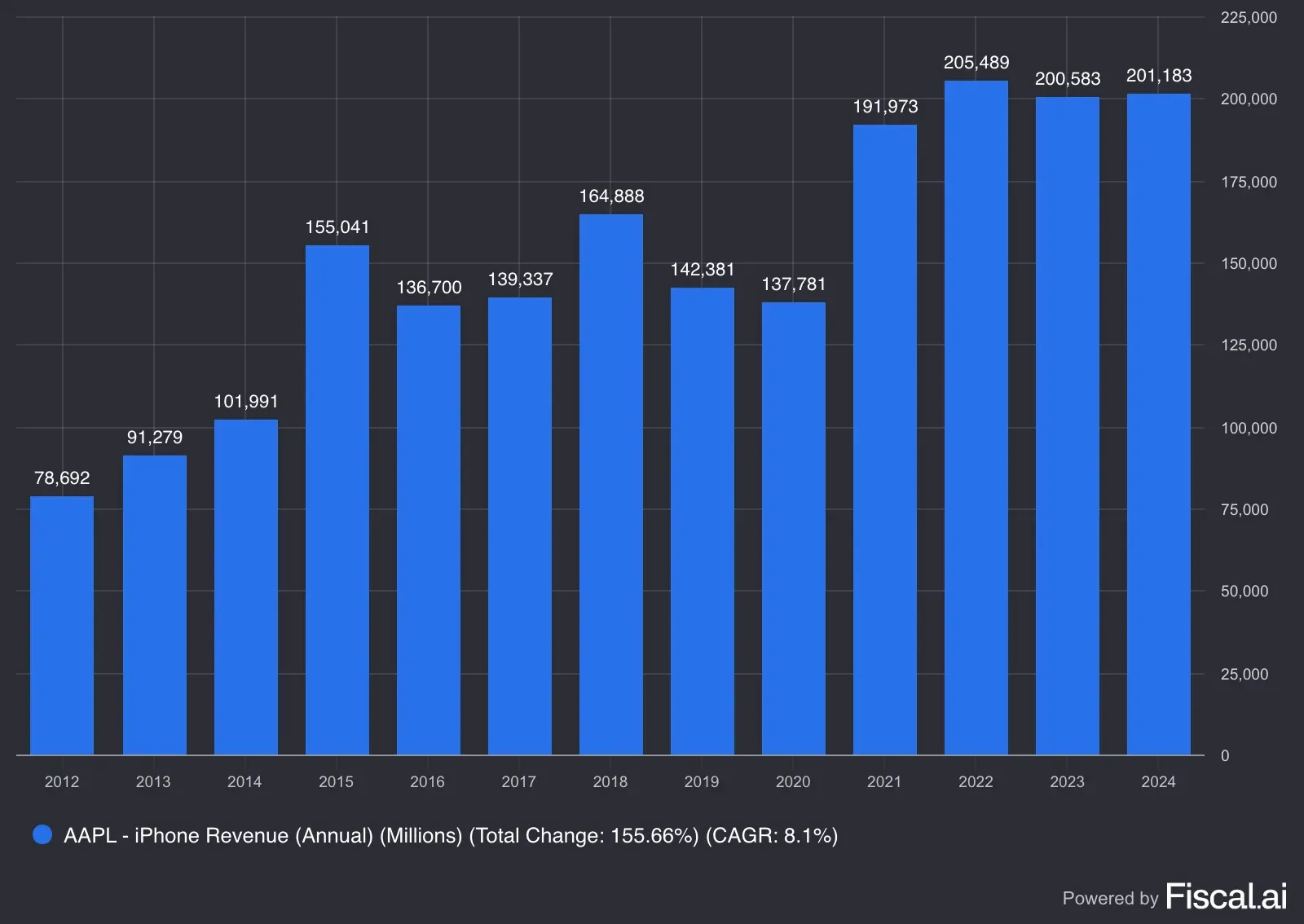

Revenue growth, however, has slowed notably as the sales growth of iPhone, its cash cow, plateaus.

Chart courtesy of Fiscal.ai

iPhone revenue has soared to $201.18 billion in 2024 from $78.69 billion in fiscal year 2012.

Chart courtesy of Fiscal.ai

Cook is considered a master negotiator as he shouldered the company and took it through several rough patches engendered by the U.S.-China political standoffs. More recently, as President Donald Trump took a hard stance on the country through his tariffs, the Apple CEO responded by diversifying out of China into other Asian nations such as India and Vietnam.

Even as Trump applied pressure on Apple to bring production onshore, Cook met the president at the White House and announced a $100 billion investment toward furthering U.S. manufacturing.

Bloomberg’s Mark Gurman said in a report last month that Cook may not step down in the foreseeable future. His comments came as Apple veteran and longtime COO Jeff Williams announced his decision to leave.

Gurman said Cook, who would turn 65 in November, could stay on as CEO for at least another five years. He attributed his view to a board that was friendly to Cook, which included Arthur Levinson, Susan Wagner, and Ronald Sugar.

On Stocktwits, sentiment toward Apple stock was ‘bearish’ (25/100) late Sunday, and the message volume on the stream was ‘extremely low.’ Investors are concerned that Apple’s artificial intelligence (AI) missteps may come back to haunt the company.

The Apple CEO now has a tough ask. Under Cook, Apple hasn’t found a potent predecessor to its flagship iPhone. The company had unsuccessfully attempted to enter the electric vehicle market, and the Vision Pro mixed-reality headset it launched failed to meet initial expectations.

Reflecting the fundamental woes, Apple stock is now down nearly 9% for the year, the second-worst performer among the Magnificent Seven stocks.

For updates and corrections, email newsroom[at]stocktwits[dot]com.

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/large_stock_rising_resized_f17852d7aa.jpg)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/unnamed_jpg_9dff551b50.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2194650023_jpg_2af2244b5a.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Aashika_Suresh_Profile_Picture_jpg_2acd6f446c.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2227669423_jpg_f410427536.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_cathie_wood_OG_2_jpg_c5be4c4636.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Getty_Images_2233055049_jpg_0a316df698.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/jaiveer_jpg_280ad67f36.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2228864541_jpg_d94770c5a8.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/vivekkrishnanphotography_58_jpg_0e45f66a62.webp)