Advertisement|Remove ads.

Is Upstart The Latest Meme Stock Craze? Hedge Fund Manager Behind Opendoor's Rally Now Long On Lending Platform

Upstart Holdings (UPST) stock experienced a surge in retail chatter on Wednesday after hedge fund manager Eric Jackson announced that he had established a long position in the lending platform, sparking renewed interest among retail investors amid the meme stock frenzy.

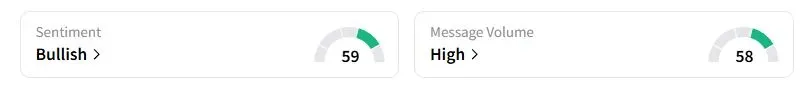

The stock gained 3.6% in the regular session. Retail sentiment on Stocktwits for Upstart was in the ‘bullish’ territory at the time of writing, while message volume surged 96% over the past 24 hours.

Jackson, the founder of EMJ Capital, praised the company in a series of posts on X, stating that the stock could reach its all-time high of $400 once again and surge to $1,200 by 2028. However, he emphasized that it is not a meme stock.

Upstart is scheduled to report its earnings on Aug. 5. “If they confirm the growth re-acceleration I see, the door gets very narrow, very fast,” said Jackson, whose posts have primarily contributed to the meme stock rally this month.

The company collaborates with banks and credit unions, offering them its lending platform and access to a broader pool of potential borrowers. It uses artificial intelligence to analyze creditworthiness.

“Top-line growth will rebound 50% next year, 70% in ‘26 as the macro flips,” Jackson said before adding that the estimates could be lower if the Federal Reserve cuts interest rates deeper and faster.

According to Koyfin data, the stock has a short interest of 22.3%. Over the past few weeks, several stocks, including Opendoor and Kohl’s, have seen a meme stock-like rally, with users on Stocktwits calling out short interest.

“Well, this is about to explode. Buckle Up,” One user wrote.

Another user wrote that if Fed Chair Jerome Powell cuts interest rates or leaves his position, the stock will “boom over 100 easily.”

A meme stock rally typically occurs when retail traders sense a short squeeze, a phenomenon in which short sellers are forced to buy back shares to cover their positions and limit losses amid a rapid increase in the share price.

Upstart stock has gained 33% this year.

Also See: Ford Flags $2B Tariff Headwind, Slashes Full-Year Outlook; But Bulls See Opportunity In EV Expansion

For updates and corrections, email newsroom[at]stocktwits[dot]com.

/filters:format(webp)https://news.stocktwits-cdn.com/large_blue_owl_capital_jpg_4d9954c2ac.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/Rounak_Author_Image_7607005b05.png)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2227553061_jpg_699278f844.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/IMG_4530_jpeg_a09abb56e6.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/large_trump_media_and_technology_group_media_009b60f8cd.jpg)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/IMG_9209_1_d9c1acde92.jpeg)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/large_HP_corporate_logo_resized_a2479d3136.jpg)

/filters:format(webp)https://news.stocktwits-cdn.com/large_terawulf_OG_jpg_a87a18705d.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/Prabhjote_DP_67623a9828.jpg)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/large_US_stocks_3e2253bcca.jpg)

/filters:format(webp)https://news.stocktwits-cdn.com/Revised_Profile_JPG_0e0afdf5e2.webp)