Advertisement|Remove ads.

Can Opendoor Stay In The Meme Stock Race? Retail Still Wants To Load Up On The Shares

Opendoor Technologies Inc. (OPEN) garnered attention this week after a wave of online hype propelled its stock significantly, only for the rally to quickly lose steam.

Retail investors, enthused by Reddit and social media buzz, sparked a dramatic rally that has pushed the stock up nearly 300% in July.

Over the past week, the stock experienced a 1,302% surge in Stocktwits retail chatter.

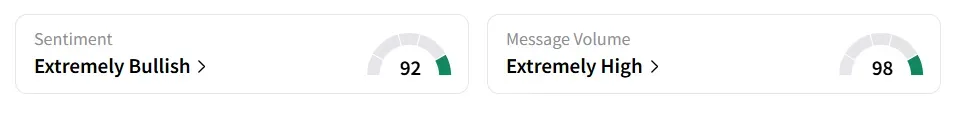

Retail sentiment around Opendoor remained in ‘extremely bullish’ (92/100) territory amid ‘extremely high’ (98/100) message volume levels.

After an explosive run, Opendoor stock fell over 22% on Wednesday afternoon.

Stocktwits users said this is the right time to load up the stock.

Opendoor shares saw a surge last week after Eric Jackson, founder of EMJ Capital, suggested the stock has the potential to climb to $82, assuming the company adopts certain strategic shifts.

He compared Opendoor’s possible trajectory to that of Carvana, which transformed the online used car market with its digital sales model.

Opendoor wasn’t the only name drawing trader attention. Kohl’s Corp. (KSS) shares jumped nearly 38% on Tuesday, amid heavy short interest and a flurry of speculative trading.

According to a CNBC report, Opendoor went public in 2020 through a special purpose acquisition company during a period of low interest rates and speculative market behavior.

Its tech-driven model focuses on buying and reselling homes. The recent rally echoes earlier periods of pandemic-fueled hype, but it arrives in a more cautious market environment.

Opendoor stock has gained over 44% year-to-date, but has shed more than 10% in the last 12 months.

For updates and corrections, email newsroom[at]stocktwits[dot]com.

/filters:format(webp)https://news.stocktwits-cdn.com/large_lantheus_jpg_e10c71c486.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/unnamed_jpg_9dff551b50.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_nio_battery_swap_jpg_de98f34bea.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/large_sealsq_stock_market_representative_resized_b05435011f.jpg)

/filters:format(webp)https://news.stocktwits-cdn.com/large_anthropic_OG_jpg_51bd14bc5d.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Aashika_Suresh_Profile_Picture_jpg_2acd6f446c.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Getty_Images_2233516954_jpg_72241a7246.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Oil_tanker_resized_jpg_bb40d4bd7e.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/jaiveer_jpg_280ad67f36.webp)