Advertisement|Remove ads.

Is Waaree Renewables Set For Next Rally? SEBI Analyst Highlights Breakout Signals

Waaree Renewable Technologies shares surged over 2% following a mega order win. The company received a Letter of Award (LoA) worth ₹1,252 crore for a solar power project.

The order is for executing an 870 MWac/1,218 MWp grid-connected ground-mount solar project, and the project is expected to be completed in FY27.

SEBI-registered analyst Rajneesh Sharma believes that Waaree Renewables stock is on the brink of a breakout, supported by a strong Q1, growing BESS focus, and a maturing base on the chart.

Waaree is also expanding its global footprint by exploring EPC opportunities in the Middle East. Management has guided for a sustainable EBITDA margin of 14–16%. Its financial performance in the first quarter (Q1 FY26) was solid, with revenues surging 155% and profits rising 206%. During the quarter, the company announced new orders of 566 MW worth ₹720 crore.

According to Sharma, Waaree has shown impressive long-term growth. Its stock price CAGR over five years stands at 220% and over ten years at 78%. Compounded profit growth has been 273% over five years and 124% over the last three.

The company remains virtually debt-free, with a Debt/EBITDA ratio of just 0.07. But, valuation remains on the higher side, with a price-to-book ratio of 23.7 times, making it richly valued compared to peers.

Technical Watch

On the technical side, Waaree’s stock has been consolidating within a Darvas Box range of ₹880.90 to ₹1,200. Sharma identified strong support levels at ₹880.90 and ₹726.70, while resistance levels were seen at ₹1,261.15, ₹1,619.75, ₹1,869, and ₹2,168.60.

He noted that the stock pattern indicated a volatility squeeze and base formation. Additionally, volume declines during consolidation suggest a potential breakout. Its Relative Strength Index (RSI) stood at 49.45, indicating neutral-to-bullish momentum.

What Should Traders Do?

Sharma shared a neutral to cautiously bullish outlook for the short-term (2–4 weeks), while the medium-term bias is bullish if the stock breaches ₹1,261. Over the long term (6–12 months), a trend reversal is likely above ₹1,619, with targets set at ₹1,869–₹2,168.

What Is The Retail Mood?

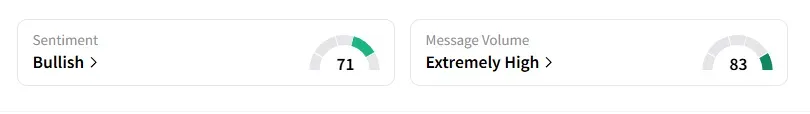

Data on Stocktwits shows that retail sentiment has been ‘bullish’ on this counter amid ‘extremely high’ message volumes.

Waaree Renewables shares have risen 17% year-to-date (YTD).

For updates and corrections, email newsroom[at]stocktwits[dot]com.

/filters:format(webp)https://news.stocktwits-cdn.com/Getty_Images_2250929484_jpg_8206df84ab.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/IMG_8805_JPG_6768aaedc3.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2215390052_jpg_84ddd1faac.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/IMG_9209_1_d9c1acde92.jpeg)

/filters:format(webp)https://news.stocktwits-cdn.com/Getty_Images_2177851484_jpg_b969f68c05.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/IMG_4530_jpeg_a09abb56e6.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Getty_Images_2158238458_jpg_48ab7af27c.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Rocketlab_resized_jpg_92c1a02a7f.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/unnamed_jpg_9dff551b50.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2201668075_jpg_cae68c6d02.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/jaiveer_jpg_280ad67f36.webp)