Advertisement|Remove ads.

JBM Auto Stock Rises Nearly 8% After IFC Funding Clears Road For Electric Bus Rollout Across 3 States

Shares of JBM Auto surged nearly 8% to ₹684.3 in early trade after its subsidiary received a $100 million investment to deploy electric buses in Maharashtra, Assam, and Gujarat.

On Thursday, JBM Auto announced that its unit JBM ECOLIFE Mobility secured a $100 million long-term capital investment from the International Finance Corporation (IFC). The funds will be used to deploy 1,455 modern, air-conditioned electric buses across cities in Maharashtra, Assam, and Gujarat.

According to the press release, this marks the first time that projects in Maharashtra and Assam, tendered under the Pradhan Mantri e-Bus Sewa Scheme, will use a Payment Security Mechanism (PSM) to reduce payment risks linked to municipal and state transport undertakings. This mechanism is expected to improve the financial viability of e-bus projects and pave the way for broader adoption nationwide.

The move is in line with the Centre’s goals of 40% e-bus penetration by FY2030. This deal also marks IFC’s first investment in the e-bus sector in Asia and its largest globally.

JBM has already deployed over 2,500 e-buses across 10 states and 15 airports, with an order book of 11,000 units under execution.

Technical Take

The stock had been forming lower tops and bottoms on the medium-term chart, moving within a downward-sloping channel, said SEBI-registered analyst Prabhat Mittal.

In May 2025, it broke out of this channel but faced resistance twice near the ₹765 level. On the downside, it found strong support around ₹590 on two occasions, Mittal said.

Currently, the stock has crossed all key moving averages, 20-day, 50-day, 100-day, and 200-day, which signals improving momentum, the analyst said.

Mittal recommends taking up fresh positions in the ₹650 - ₹660 zone with a strict stop loss at ₹580. The immediate target remains ₹770, and a breakout above this resistance could lead to the ₹900 - ₹1,000 range over the medium to long term.

Stock Watch

JBM Auto posted mixed Q1 results at the end of July. Net profit fell marginally to ₹32.1 crore, despite a 16.9% increase in total income. Since then, JBM Auto shares have climbed 3.8%.

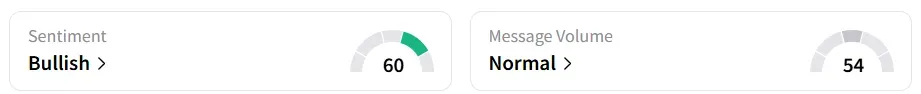

Retail sentiment on Stocktwits turned to 'bullish' from 'neutral' a day earlier. It was the top trending stock on the platform.

However, on a year-to-date basis, the stock has fallen by over 12%.

For updates and corrections, email newsroom[at]stocktwits[dot]com.

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2256076198_jpg_06e5c2fdb6.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/IMG_9209_1_d9c1acde92.jpeg)

/filters:format(webp)https://news.stocktwits-cdn.com/large_pharma_stock_jpg_490939e580.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/IMG_8805_JPG_6768aaedc3.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_stablecoin_rep_jpg_5ec196dfc2.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/Prabhjote_DP_67623a9828.jpg)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2228901342_jpg_7365e02c40.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/IMG_4530_jpeg_a09abb56e6.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2218742693_jpg_8d1b39840a.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2195880631_jpg_5d50833996.webp)