Advertisement|Remove ads.

Jefferies Believes Microsoft Will Shell Out Decent Premium To Constellation Energy For Three Mile Island Power

Microsoft Corp (MSFT) will shell out a decent premium to Constellation Energy Corp. (CEG) for the power from Three Mile Island nuclear reactor, said Jefferies according to a Bloomberg report.

The tech giant will pay Constellation Energy a minimum of $112 per megawatt-hour for power compared to about $60 per megawatt-hour for wind and solar energy currently available in the same region, the report said citing Jefferies.

As the AI boom leads to more data center operations, technology companies are rushing to line up power sources for these operations, leading to a huge demand for natural gas-fired plants and nuclear power plants.

Paul Zimbardo, an analyst at Jefferies, reportedly said the deal should provide Constellation with approximately $785 million in annual revenue by 2030 and that’s enough to justify the anticipated $1.6 billion expenditure to restart the reactor.

“That is not cheap for electricity,” said Zimbardo. “It’s a healthy premium to what you would pay if you just bought grid power.”

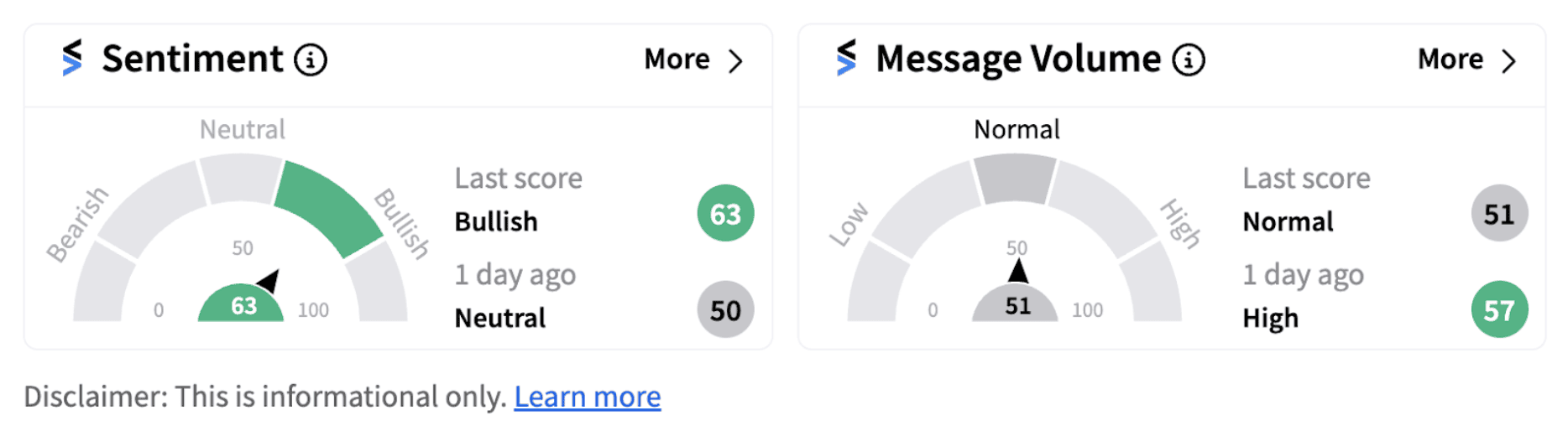

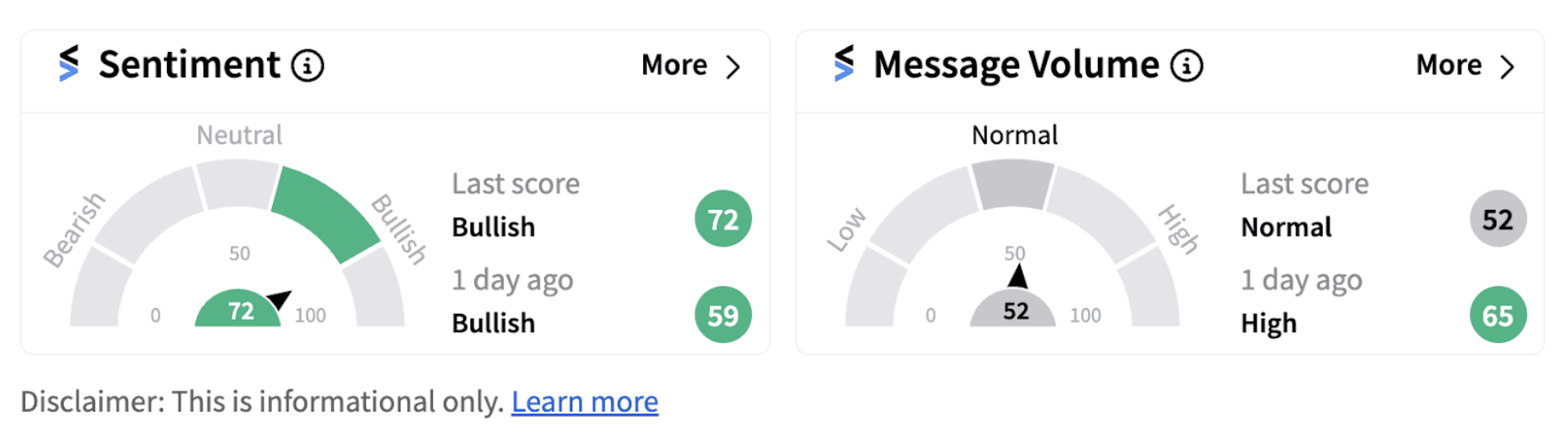

Retail sentiments for both Microsoft and Constellation Energy were trending in the ‘bullish’ territory on Wednesday.

Constellation Energy recently signed its largest-ever power purchase agreement with Microsoft which will see the launch of the Crane Clean Energy Center (CCEC) and restart the shuttered Three Mile Island Unit 1 for providing nuclear energy to the tech giant.

The Three Mile Island site had witnessed a partial meltdown of one of its reactors in 1979 and hasn’t been in operation since 2019 when its other reactor stopped operations due to economic reasons.

Under the 20-year power purchase agreement, Microsoft will purchase energy from the renewed plant as part of its goal to help match the power its data centers in PJM use with carbon-free energy.

Recently, Morgan Stanley increased its price target on Constellation Energy to $313 from $233. The brokerage believes that just the Unit 1 reactor alone could add $1.70 per share in incremental earnings and $445 million in net income and also noted that the operational risk to bring it back online in 2028 appears manageable.

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_1494564204_jpg_be6f667516.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/unnamed_jpg_9dff551b50.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2259256580_jpg_e72ea8ddc5.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/jaiveer_jpg_280ad67f36.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_supermicro_resized_jpg_95d12828d5.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Aashika_Suresh_Profile_Picture_jpg_2acd6f446c.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/large_UWM_resized_f22f7e06b8.jpg)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/large_sealsq_stock_market_representative_resized_b05435011f.jpg)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2229918735_jpg_e905cbd5e3.webp)