Advertisement|Remove ads.

Morgan Stanley Raised Constellation Energy Price Target To $313: Why’s Retail Disappointed?

Morgan Stanley has reportedly increased its price target on Constellation Energy Corp (CEG) to $313 from $233 in the wake of the firm planning to restart the Three Mile Island nuclear plant in Pennsylvania.

The brokerage believes that just the Unit 1 reactor alone could add $1.70 per share in incremental earnings and $445 million in net income, according to a report, while noting that the operational risk to bring it back online in 2028 appears manageable.

Morgan Stanley also sees this as a strong indicator of future nuclear power contracts and forecasts higher prices for future deals.

"Operational risk to bring the plant online appears manageable, the contract is very long (20yrs) and with a strong counterparty," said Morgan Stanley, according to a report. "Bringing nuclear online supports the grid, with no emissions and 24x7 operations, and the move has generated strong political support."

Last week, Constellation Energy signed its largest-ever power purchase agreement with Microsoft Corp (MSFT) which will see the launch of the Crane Clean Energy Center (CCEC) and restart the shuttered Three Mile Island Unit 1 for providing nuclear energy to the tech giant.

The Three Mile Island site witnessed a partial meltdown of one of its reactors in 1979 and hasn’t been in operation since 2019 when its other reactor stopped operations due to economic reasons.

Under the 20-year power purchase agreement, Microsoft will purchase energy from the renewed plant as part of its goal to help match the power its data centers in PJM use with carbon-free energy.

The firm had purchased TMI Unit 1, in 1999. Prior to its shutdown in 2019, the plant had a generating capacity of 837 megawatts, enough to power more than 800,000 average homes.

Shares of Constellation Energy had soared on Friday following the announcement. However, the stock was in the red on Monday, failing to sustain above the $260 mark.

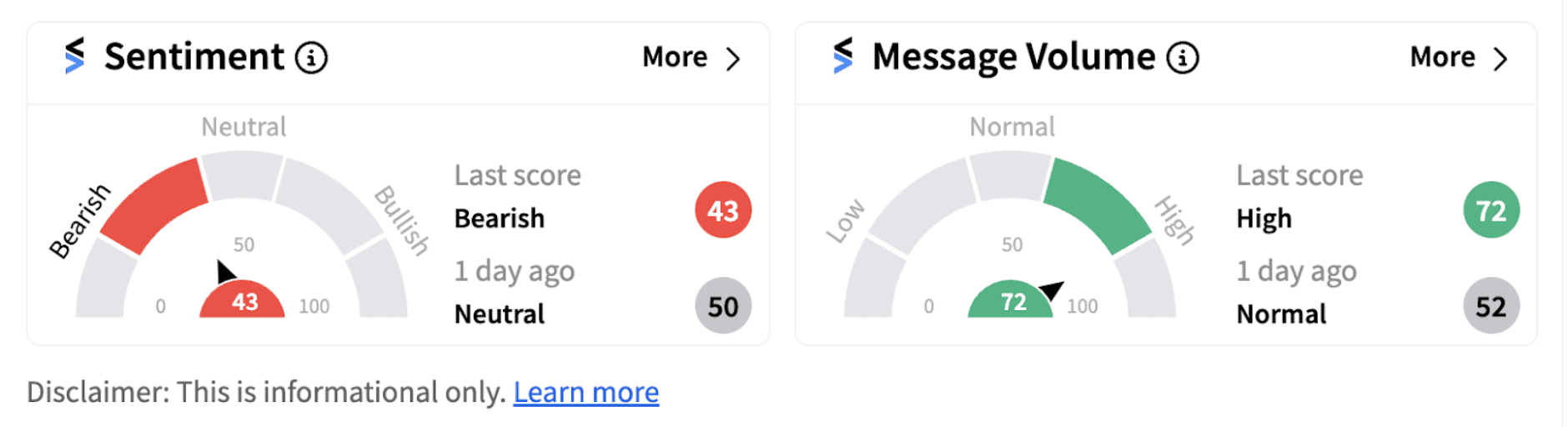

Retail sentiment on Stocktwits took a hit with the sentiment meter entering the ‘bearish’ territory (43/100) from the ‘neutral’ zone a day ago.

One Stocktwits user named ‘Knightrader1’ expressed disappointment at the stock’s inability to cross the $260 mark.

Also See: Southwest COO Warns Employees Of ‘Tough Decisions’ Going Ahead: Retail On Wait-And-Watch Mode

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2199618807_jpg_0e9f26c6c5.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/jaiveer_jpg_280ad67f36.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2262651778_jpg_54075aa1d9.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Aashika_Suresh_Profile_Picture_jpg_2acd6f446c.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2246580703_jpg_9700e1e7e8.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/unnamed_jpg_9dff551b50.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2189643067_jpg_243b1172b6.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_1494564204_jpg_be6f667516.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2259256580_jpg_e72ea8ddc5.webp)