Advertisement|Remove ads.

Jefferies Says ‘Buy The Pullback’ At Meta — What Upside Does The Analyst See?

- Jefferies pointed to an "attractive" risk-reward ratio for Meta at the current discount to Alphabet.

- The analyst also cited what it views as "moderate downside" to estimates and stronger upside potential.

- Jefferies praised the company’s AI hires and added that it views it as "set to deliver" in 2026.

Meta Platforms Inc. (META) is an attractive buy at current levels, according to Jefferies.

The analyst has a ‘Buy’ rating on the company with a target price of $910, which represents an upside of over 40% compared to the $645 levels it was trading at on Thursday at the time of writing.

The analyst outlined five reasons to buy the pullback in Meta in a note, according to TheFly.

Shares of META gained over 5% on Thursday morning.

The Upside Rationale

Jefferies pointed to an "attractive" risk-reward ratio for Meta at the current discount to Alphabet Inc. (GOOGL). Shares of META have lost over 8% in the past six months while GOOGL shares have gained over 73% in the same period.

The analyst also cited what it views as "moderate downside" to estimates and stronger upside potential. Jefferies praised the company’s AI hires and added that it views it as "set to deliver" in 2026.

Apart from the above, the analyst cited continued momentum from Meta's core flywheel powered by AI as another positive for the company. Jefferies also noted the accelerating activation of major incremental revenue engines, including WhatsApp, Threads and Llama/AI as another optimistic avenue for the company.

Meta’s AI Push

Earlier this month, the social media giant’s chief Mark Zuckerberg announced a new “top-level initiative” called Meta Compute to build tens of gigawatts this decade and also to scale up to hundreds of gigawatts or more over time.

“How we engineer, invest, and partner to build this infrastructure will become a strategic advantage,” Zuckerberg had said at the time.

Meta also named Dina Powell McCormick as President and Vice Chairman, a move to help meet its compute and infrastructure goals. In 2025, Meta announced an investment of $600 billion in the U.S. by 2028 to build AI data centers to expand its AI strategy to compete with peers like OpenAI and Google.

The company laid off about 10% of workers in the Reality Labs business, including those working on metaverse, as it shifts its focus to AI.

On Wednesday, Meta rolled out advertising on Threads globally, expected to go live next week. “With ads on Threads, businesses can authentically join this conversation while finding new ways to connect with the people most interested in their business,” the company said in a blog. Threads is likely to become a significant revenue driver for the company.

Meta is due to report its fourth-quarter 2025 earnings on Jan. 28.

How Did Stocktwits Users React?

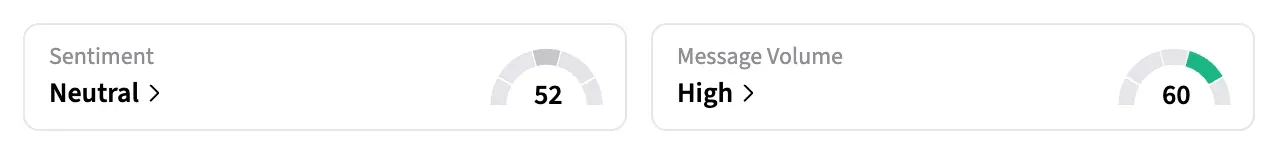

On Stocktwits, retail sentiment around META stock jumped to ‘neutral’ from ‘bearish’ territory over the past day amid ‘high’ message volumes.

One bullish user called it a ‘great day’ for the company after the positive comments from Jefferies.

Another user called the stock ‘insanely cheap.’

Shares of META have gained over 3.7% in the past year.

For updates and corrections, email newsroom[at]stocktwits[dot]com.

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_140648412_jpg_05552b4117.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Anushka_Basu_make_me_smile_in_the_picture_b92832aa_af59_4141_aacc_4180d2241ba8_1_2_png_1086e0ed8c.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_912727778_jpg_3bd44c57ad.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_1235943608_jpg_91702ef0ab.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_167578473_jpg_29255f031f.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Michael_Burry_jpg_fa0de6ac92.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_winklevoss_1c7de389e0.webp)