Advertisement|Remove ads.

Jefferies' Randy Konik Sees Nike Getting 'Its Act Together' Under CEO Elliott Hill

- Konik said early signs of Hill’s strategy are already visible in North America, where inventory is healthier, and margins are improving.

- He acknowledged Nike’s weakness in China, especially in the latest quarter, but added that it could even out when you lap those comparisons in four quarters.

- Nike’s position in a highly attractive footwear category, limited competitive threats, leadership status, and strong brand moat will make it special in 2026, he added.

Jefferies believes Nike is poised for a comeback under the leadership of Elliott Hill, a long-time company veteran who became the footwear company’s chief executive officer in October 2024.

“Nike is going to get its act together,” said Randy Konik, Jefferies managing director, on CNBC’s 'Squawk on the Street'. “They had the wrong CEO. They have the right CEO now,” he added.

Konik said early signs of Hill’s strategy are already visible in North America, where inventory is healthier, and margins are improving.

Shares of Nike are up marginally, climbing 0.05% in Friday morning trade at the time of writing.

Better Solutions

Nike has struggled with leadership changes, management resets, excess inventory, and slow turnaround over the past few years. The sneaker brand also faced stiff competition and a challenging economic climate, particularly in China, which was further squeezed by the recent tariff wars.

Given Hill's 35 years of experience at Nike, he is implementing better solutions, Konik added. “He knows how to fix the culture, and he knows how to fix the problem through an easy playbook: fixing product and balancing distribution,” he said.

In its latest quarterly results, Nike’s sales in China fell 17% in the second quarter (Q2) of 2026, while footwear sales declined 21% for the same period. Nearly 15% of Nike’s annual revenue comes from China. Meanwhile, overall sales in North America grew by 9% in the same period.

Konik acknowledged the weakness in China, saying it was a tough quarter for Nike but added that “it can become good when you lap those comparisons in four quarters.”

Cook’s Confidence

Recently, Apple CEO Tim Cook purchased about $3 million of Nike’s stock in the open market, reiterating his confidence in the company. Cook is also on Nike’s board.

Konik said that in the global sneaker market, only about 10 players truly matter, and even after giving up some share, Nike remains the leader and is still well positioned. He cited the company’s position in a highly attractive category, limited competitive threats, leadership status, and strong brand moat as favorable.

“That’s what makes Nike special for next year. And that’s what Tim Cook saw, I think, with his stock purchase,” Konik noted. “The best part of Nike is it can use its own playbook,” he added.

Earlier on Friday, UBS also expressed its confidence in Nike’s brand and said it continues to believe its business will improve. The firm maintained a price target of $62 on Nike shares and reiterated its ‘Neutral’ rating.

How Did Stocktwits Users React?

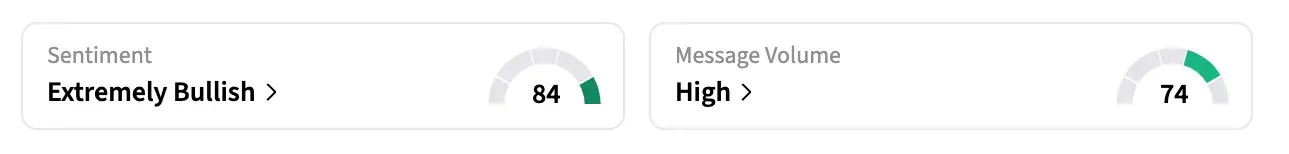

On Stocktwits, retail sentiment around NKE shares trended in ‘extremely bullish’ amid ‘high’ message levels.

Shares of NKE are down over 22% in the past year.

For updates and corrections, email newsroom[at]stocktwits[dot]com.

Also Read: Nike Turnaround Faces A Longer Road Despite Brand Strength, UBS Says

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2250240977_jpg_5b777d96ef.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/jaiveer_jpg_280ad67f36.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2206295220_jpg_1057588802.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/Rounak_Author_Image_7607005b05.png)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Trending_stock_resized_may_jpg_bc23339ae7.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/vivekkrishnanphotography_58_jpg_0e45f66a62.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2247614893_jpg_e1dcf2d2f6.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Aashika_Suresh_Profile_Picture_jpg_2acd6f446c.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Sound_Hound_jpg_7961ee756a.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/shivani_photo_jpg_dd6e01afa4.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2191702229_jpg_e9b50f268b.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/unnamed_jpg_9dff551b50.webp)