Advertisement|Remove ads.

Jefferies Upgrades Disney To 'Buy' On Future Cruise, Content Upsides: Retail Mood Improves

Retail investors welcomed a key rating upgrade for Walt Disney (DIS), underscoring gains from the media giant's recent efforts to streamline its business.

Jefferies upgraded Disney's stock to 'Buy' from 'Hold' and also bumped its price target handsomely to $144 from $100. The current target indicates a 16% upside from current levels.

Disney's shares rose 1.4% on Monday, marking the sixth straight day of gains.

Jefferies noted that it sees improvement in several of the company's business lines. It said Disney will commission two new cruise ships in Q1 next year, a major catalyst that could drive incremental revenue of up to $1.5 billion.

Jefferies is also optimistic about the core content business, given a strong slate of upcoming releases, including "Avatar 3" and "Zootopia 2," alongside the launch of ESPN's new streaming service.

"DIS is leaning more and more into its key differentiations of bundling, studio releases, and sports, where our data suggests this strategy is working, with DIS+ web visits growing 40%+ y/y in each of [the] last 3 months," Jefferies analysts said in the note.

"Stronger user growth and content coupled with advertising (new AMZN partnership) should drive enhanced scale and margins."

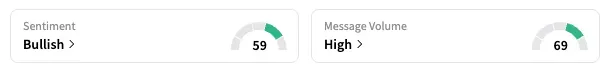

On Stocktwits, the retail sentiment for DIS shifted to 'bullish' as of early Tuesday from 'neutral.'

Disney's shares have gained considerably after the company's second-quarter earnings report, which also included a bullish outlook for 2025. DIS shares are up over 35% since May 7, and 11.4% year-to-date.

Disney reinstated Bob Iger as CEO in late 2022, replacing Bob Chapek amid investor pressure. Since returning, Iger has cut costs, restructured divisions, and prioritized profitability in its streaming offering.

For updates and corrections, email newsroom[at]stocktwits[dot]com.

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2207049226_jpg_7f1e685123.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/IMG_4530_jpeg_a09abb56e6.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_us_stocks_war_jpg_f2a208ae56.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/IMG_8805_JPG_6768aaedc3.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_M_and_A_deals_acquisitions_resized_jpg_a56d5b5e28.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/jaiveer_jpg_280ad67f36.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/large_semtech_logo_resized_jpg_f9b0e1e71e.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Aashika_Suresh_Profile_Picture_jpg_2acd6f446c.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_ross_stores_resized_jpg_e7e996e005.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/unnamed_jpg_9dff551b50.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Getty_Images_2252956558_jpg_2dc0e5e537.webp)