Advertisement|Remove ads.

Short Seller Who Predicted Enron’s Collapse Joins Michael Burry In Sounding AI Alarm — Flags Cracks In CoreWeave’s Balance Sheet

- Chanos said CoreWeave’s margins were contracting, despite the CEO’s claim that the company was achieving renewals within 5% of the original contract price when the Nvidia H100 clusters came off contract.

- Following Q3 disappointment, the company received a raft of price target cuts from Wall Street firms, with the new estimates ranging from $99 to $160.

- Retail, however, wasn’t willing to throw in the towel yet, pledging allegiance to the stock.

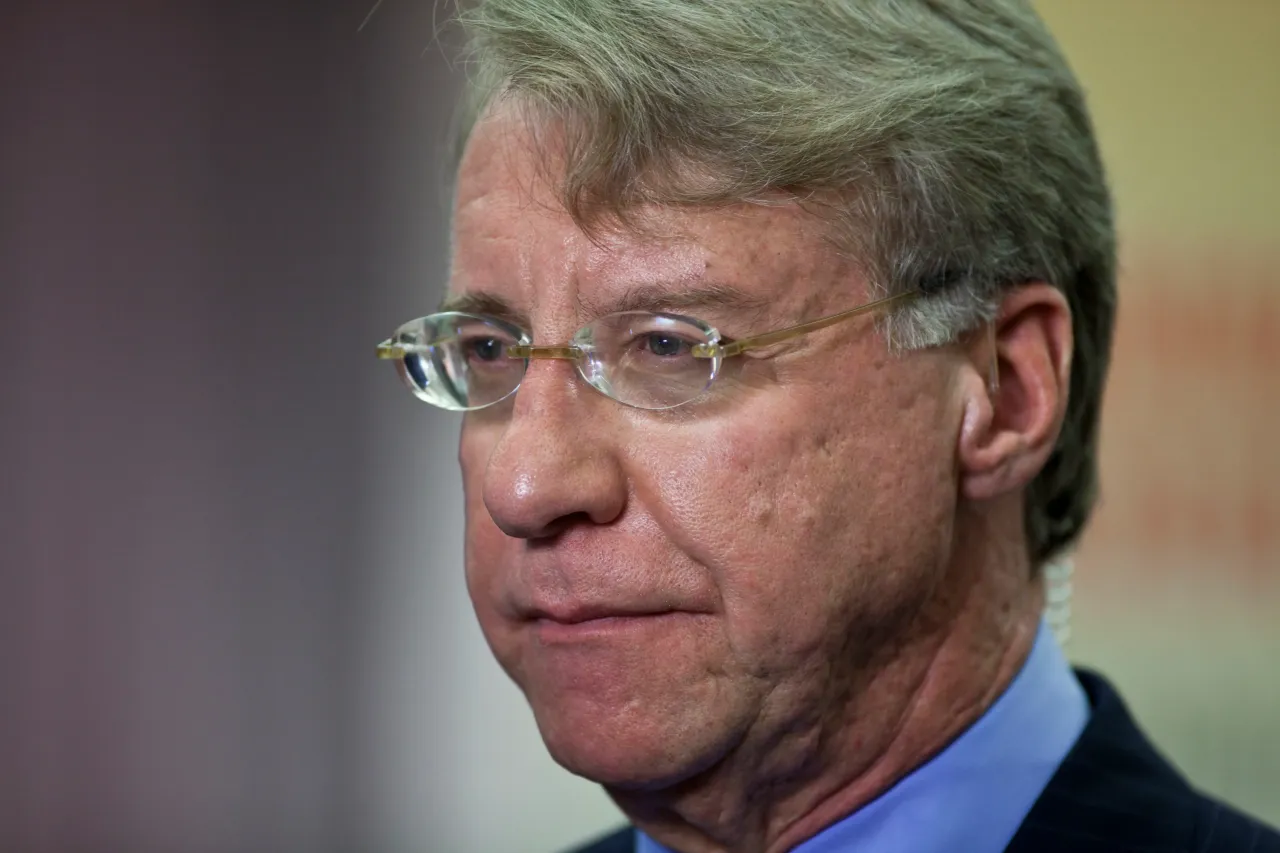

CoreWeave, Inc. (CRWV) stock slumped 16% in Tuesday’s regular session after the artificial intelligence (AI) company lowered its guidance, citing a delay at one of its third-party data center partners. Short seller Jim Chanos, however, flagged a far deeper issue with the company, which counts Nvidia among its partners.

Chanos, the founder of Kynikos Associates, shot to fame by predicting the collapse of energy company Enron before it filed for bankruptcy in 2001.

Chanos Raises Red Flags

Posting on X on Tuesday, Chanos said even with a longer depreciable life, CoreWeave’s third-quarter numbers suggest the company is barely profitable. Working out the math, the short seller noted that the company’s annualized adjusted earnings before interest, taxes, depreciation and amortization (EBITDA) is $3.4 billion and annualized interest is $1.2 billion. And he assumed a "generous" 10-year lifetime for the GPUs, with an estimated value of $20 billion.

Chanos had previously weighed in on the issue in a series of posts on X in October. When CoreWeave CEO Michael Intrator was asked by Jim Cramer about “rapid asset obsolescence” during an interview, he stated that his customers were willing to rent GPUs for 6 or 7 years. Using the $19.1 billion in capital employed by the company during the second quarter, and using the high end of Intrator’s useful life estimate, yielded a 0% return on invested capital (ROIC), Chanos had said.

On Tuesday, Chanos referred to Intrator’s comments on the third-quarter earnings call, specifically about customers receiving a renewal within 5% of the original contract price when the Nvidia H100 clusters come off contract. He pointed out that, despite that, margins were contracting.

Broader Industry Malaise?

Chanos’ CoreWeave-specific rant echoes the recent commentary of Scion Asset Management founder Michael Burry on AI hyperscalers. According to Scion’s 13F report, the firm made massive short bets against AI darlings Nvidia and Palantir. Burry also posted a few times on X, raising an alarm about an AI bubble forming.

As recently as Monday, Burry called extending the useful life of assets that artificially boost earnings as one of the more common frauds of the modern era. “Massively ramping capex through purchase of Nvidia chips/servers on a 2-3 yr product cycle should not result in the extension of useful lives of compute equipment.” According to his estimates, hyperscalers will likely understate depreciation by $176 billion over 2026-2028. This would inflate Oracle's earnings by nearly 27% by 2028 and Meta’s by about 21%, according to Burry. He also promised more insights on Nov. 25

SoftBank’s (SFTBY) CEO Masayoshi Son, who prides himself as an AI evangelist, shocked the market on Tuesday by disclosing that the investment holding company has cashed out of its Nvidia holdings. This sent the stock tumbling by about 3% on Tuesday.

Retail Backs CoreWeave To Hilt

Despite the AI pessimism and doubts regarding CoreWeave’s balance sheet, retail users of the Stocktwits platform were ‘extremely bullish’ on the stock, and the message volume also remained ‘extremely high.’

An ongoing Stocktwits poll asking users what they were doing with CoreWeave stock found that 37% stayed on the sidelines, 35% bought more, and 12% were holders. Only 16% said they were selling or trimming.

Despite Tuesday’s plunge, CoreWeave stock is up about 120% this year. On Tuesday, the company received a raft of price target cuts from Wall Street firms, with the new estimates ranging from $99 to $160, according to summaries of notes available on the Fly. JPMorgan downgraded the stock, citing supply chain pressure. But most analysts flagged the stock as a long-term opportunity.

For updates and corrections, email newsroom[at]stocktwits[dot]com.

/filters:format(webp)https://news.stocktwits-cdn.com/large_Bitcoin_and_Ethereum_2b4356b70a.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Anushka_Basu_make_me_smile_in_the_picture_b92832aa_af59_4141_aacc_4180d2241ba8_1_2_png_1086e0ed8c.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_976546456_jpg_42ddd4a81d.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2259655311_jpg_20124bbeb9.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Donald_Trump_451371e34e.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2228736233_jpg_f3ebe80a4c.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2192180432_jpg_5a4c947a6a.webp)