Advertisement|Remove ads.

Jim Cramer All Praise For This ‘Legacy Technology’ CEO For Making A ‘Lot Of Money’ For Investors — But Retail Stays Away From Stock

CNBC's Mad Money host Jim Cramer heaped praise on International Business Machines Corp. (IBM) CEO Arvind Krishna for his role in reinvigorating the company's sagging growth.

“I salute this man, Arvind Krishna,” said Cramer as Big Blue’s CEO made his appearance on the media outlet’s “Squawk on the Street” segment.

The stock picker said people were now making a “lot of money” by investing in the stock, and it doesn’t get mentioned other than the day of earnings.”

Krishna, a company insider, became IBM’s CEO in April 2020, succeeding Ginni Rometty. The company’s quarterly revenue growth was mainly in the red for an extended period before Krishna took over.

The CNBC report stated that the new CEO aimed to shed IBM’s image as a “legacy technology company past its prime.” =

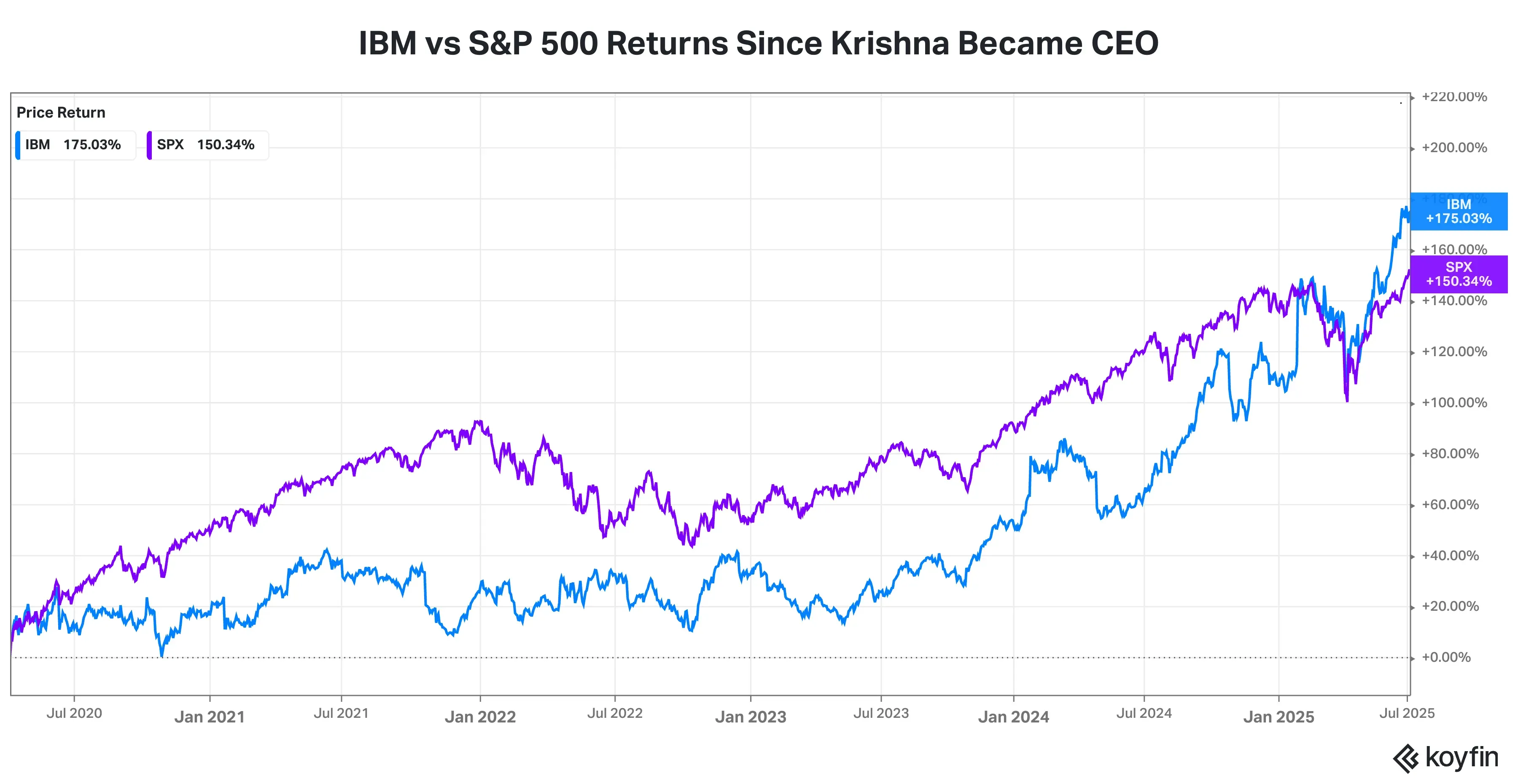

Between April 3, 2020 (the session before Krishna assumed office) and Monday, IBM stock has outpaced the S&P 500’s 150% gain.

The company’s profiling of Krishna shows that over his 30-year stint at IBM, he led a series of bold transformations and delivered proven business results. The executive also relied on inorganic growth, being instrumental in the successful $34 billion acquisition of Red Hat in 2019, which has helped IBM’s foray into the hybrid cloud market.

IBM has become a pioneer in the emerging technology area of quantum computing.

On Stocktwits, retail sentiment toward IBM stock stayed ‘bearish’ (38/100) by early Tuesday, with the message volume at a ‘normal’ level.

A bearish watcher dismissed the recent stock returns as being driven by buybacks and the use of artificial intelligence (AI) in exchange-traded fund (ETF) buying.

Another user wasn't one to be carried away by the “quantum hype,” adding that “They have a lack of talent and have a difficult time recruiting top talent.”

IBM shares have added nearly 35% year-to-date, once again outperforming the 6% rise for the S&P 500 Index.

For updates and corrections, email newsroom[at]stocktwits[dot]com.

/filters:format(webp)https://news.stocktwits-cdn.com/large_shell_resized_jpg_161ef0a394.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/jaiveer_jpg_280ad67f36.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Emirates_jpg_2620b94b3d.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_tesla_jpg_dcfe443bb4.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/unnamed_jpg_9dff551b50.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Apple_Siri_jpg_30dce91b4f.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Aashika_Suresh_Profile_Picture_jpg_2acd6f446c.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2257248307_jpg_6720435e43.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2248586785_jpg_9c6ef18a07.webp)