Advertisement|Remove ads.

Jim Cramer Urges Investors To Heed Jensen Huang’s Core AI Lesson: ‘It’s Why You Own Nvidia’

- Cramer’s vote of confidence in Nvidia and Meta comes a day after the two companies announced an expansion of their deal to use millions of AI chips from the AI bellwether in the social media giant’s data centers.

- On Tuesday, Meta and Nvidia announced a multi-year, multigenerational strategic partnership spanning on-premises, cloud and AI infrastructure.

- As part of the deal, Meta will build hyperscale data centers optimized for both training and inference, through a large-scale deployment of NVIDIA CPUs and millions of NVIDIA Blackwell and Rubin GPUs.

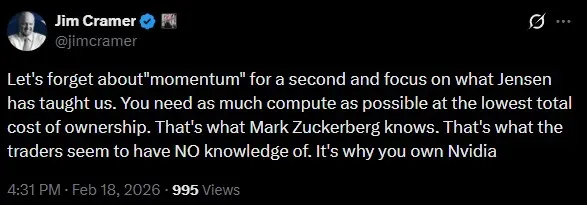

Jim Cramer on Monday urged investors to heed Nvidia Corp. (NVDA) CEO Jensen Huang’s core AI lesson, stating that this is also what Meta Platforms Inc. (META) CEO Mark Zuckerberg knows.

“Let's forget about ‘momentum’ for a second and focus on what Jensen has taught us. You need as much compute as possible at the lowest total cost of ownership,” he said in a post on X.

Cramer added that traders seem to have no knowledge of this lesson. “It’s why you own Nvidia,” he added.

Meta shares were up 0.2% in Wednesday’s pre-market trade, while Nvidia shares were up around 2%. Retail sentiment on Stocktwits around both companies trended in the ‘bearish’ territory at the time of writing.

Why Is Cramer Bullish On AI Buildout?

Cramer’s vote of confidence in Nvidia and Meta comes a day after the two companies announced an expansion of their deal to use millions of AI chips from the AI bellwether in the social media giant’s data centers.

On Tuesday, Meta and Nvidia announced a multi-year, multigenerational strategic partnership spanning on-premises, cloud, and AI infrastructure. As part of the deal, Meta will build hyperscale data centers optimized for both training and inference, through a large-scale deployment of NVIDIA CPUs and millions of NVIDIA Blackwell and Rubin GPUs.

Meta will also integrate Nvidia’s Spectrum-X Ethernet switches for the Facebook Open Switching System platform.

“We’re excited to expand our partnership with NVIDIA to build leading-edge clusters using their Vera Rubin platform to deliver personal superintelligence to everyone in the world,” said Meta founder and CEO Mark Zuckerberg.

Meltdown In Software Stocks

Cramer’s post comes amid a meltdown in U.S. software stocks in 2026. The iShares Expanded Tech-Software Sector ETF (IGV), a fund tracking software stocks, is down more than 24% year-to-date, while the Global X Artificial Intelligence & Technology ETF (AIQ) is down 5%.

In a recent podcast, Goldman Sachs analysts said some software stocks have undergone a “huge valuation derating” over the past two weeks. “If you look historically, that valuation premium is now approaching levels you reached in the global financial crisis,” said Ryan Hammond, a portfolio strategist in Goldman Sachs Research.

Explaining the selloff, Hammond highlighted the launch of Alphabet Inc.-owned (GOOG) (GOOGL) Google’s Genie 3 model, and Anthropic’s Claude Cowork tool as two of the reasons that drove investors away from these software stocks.

“But it seems to us like investors are saying these stocks traded at high valuations and have been popular for a long time. Let's reposition our portfolios first and then start to work through some of the questions later,” Hammond added.

Meanwhile, the iShares Expanded Tech-Software Sector ETF (IGV) was up 0.3% in Wednesday’s pre-market session.

META stock is down 3% year-to-date, while NVDA stock is down 1%.

Also See: Why Is GLBE Stock Rising Pre-Market Today?

For updates and corrections, email newsroom[at]stocktwits[dot]com.

/filters:format(webp)https://news.stocktwits-cdn.com/Getty_Images_2215875671_jpg_b63edc641f.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/vivekkrishnanphotography_58_jpg_0e45f66a62.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Trending_stock_resized_may_jpg_bc23339ae7.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_trump_hassett_jpg_1eb8c227c7.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/Rounak_Author_Image_7607005b05.png)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2229940320_jpg_5bc20a70df.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Anushka_Basu_make_me_smile_in_the_picture_b92832aa_af59_4141_aacc_4180d2241ba8_1_2_png_1086e0ed8c.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2203138957_jpg_dd735f9905.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Getty_Images_2216479170_jpg_edce233c83.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/shivani_photo_jpg_dd6e01afa4.webp)