Advertisement|Remove ads.

Jio Financial Shares: SEBI Analyst Sees Over 10% Upside Potential

Jio Financial shares are among the top Nifty gainers on Tuesday, rising nearly 2%. The Reliance-owned company has surged over 40% in the past six months.

Its new fund offering (NFO) from JioBlackRock Mutual Fund, the JioBlackRock Flexi Cap Fund closes subscriptions today. India’s first AI-human managed flexi-cap scheme was launched on September 23.

Available only in the growth option, the scheme carries a low expense ratio of 0.50% and requires a minimum investment of ₹500, which can be made through SIP or a lump-sum mode via the Reliance Jio platform. There is no exit load, allowing investors to redeem units at any time after allotment.

Technical Outlook

Jio Financial stock made a breakout from a cup and handle pattern back in June, but it couldn’t gain strong momentum after that. Now, the stock has come back to test the breakout area and is trading just below it, noted SEBI-registered analyst Mayank Singh Chandel.

Here’s why this level is essential: Stocks often test their breakout levels before making a new move. Chandel flagged that Jio Financial is near a support zone created by a small gap-up created on June 24. It is also holding support at a downward-sloping trendline. These factors make the current price an interesting level to watch.

Chandel recommended buying above ₹303 with a stop-loss at ₹279, for a target price around ₹351.

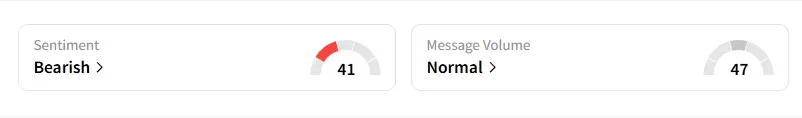

What Is The Retail Mood?

Data on Stocktwits shows that retail sentiment has been ‘bearish’ for a week.

Jio Financial shares have declined 4% year-to-date (YTD)

For udates and corrections, email newsroom[at]stocktwits[dot]com.

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2221283194_jpg_8178c730a4.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Anushka_Basu_make_me_smile_in_the_picture_b92832aa_af59_4141_aacc_4180d2241ba8_1_2_png_1086e0ed8c.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/large_Morgan_Stanley_HQ_logo_5431c7f2ad.jpg)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_1549425533_jpg_483afd6d69.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/unnamed_jpg_9dff551b50.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/large_stock_down_resized_901c19c371.jpg)

/filters:format(webp)https://news.stocktwits-cdn.com/Getty_Images_2235778544_jpg_2b7ceca102.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Aashika_Suresh_Profile_Picture_jpg_2acd6f446c.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/large_hawaiian_electric_resized_4b766fd741.jpg)

/filters:format(webp)https://news.stocktwits-cdn.com/jaiveer_jpg_280ad67f36.webp)