Advertisement|Remove ads.

Jio Financial Stock Consolidates Near Key Support: SEBI Analyst Sees Weak-To-Neutral Bias In Short Term

Jio Financial shares have been rangebound over the last month, and technical charts suggest a weak-to-neutral bias in the short term while the medium-term structure remains supportive.

SEBI-registered analyst Deepak Pal shared the technical outlook for Jio Financial stock on Stocktwits.

Technical Outlook

He noted that the stock was currently trading near ₹309–310, showing consolidation after a recent decline from the ₹335–340 zone. Multiple attempts to hold above the 20-day Exponential Moving Average (EMA) had failed, indicating short-term weakness. Additionally, it was hovering close to the 50-day EMA, which is a crucial support zone. A breakdown from here could extend weakness further, he added. However, the 100-day & 200-day EMAs are trending upwards, indicating that medium-to-long-term structure is intact.

Other technical indicators, such as the parabolic SAR, reflected ongoing bearish pressure as dots are consistently above recent candles. The Moving Average Convergence Divergence (MACD) signalled weakness in momentum. Its Relative Strength Index (RSI), around 38–39, in the lower range, indicated that the stock was nearing the oversold zone but not yet in reversal territory.

Levels To Watch

Pal identified immediate support at ₹305–308 (50 EMA zone), followed by ₹295–298 (psychological & near 200 EMA). On the upside, resistance is seen at ₹318–322 (20 EMA & recent rejection zone), followed by ₹335–340 (swing high).

What Should Traders Do?

In the short term, Pal said the bias remained weak to neutral as Jio Financial stock was consolidating near support, and a break below ₹305 could lead to further downside towards ₹295.

The medium-term outlook is constructive as long as the stock sustains above the 200 EMA (~₹285–290 zone). A sustained move above ₹322 will shift momentum to bullish, targeting ₹335–340 again.

Recent News Triggers

Recently, Jio Financial Services raised ₹3,956 crore through preferential warrant allotments at ₹316.50 per warrant. This move increased the promoter’s stake to over 51% and provided fresh capital for expansion into insurance, asset management, and digital banking.

The Jio-BlackRock joint venture also received regulatory approval to launch four passive index funds that track key indices, including the Nifty Midcap 150, Smallcap 250, Next 50, and 8–13 year government bonds. These funds are part of Jio’s broader plan to launch nearly a dozen equity and debt funds by year-end, leveraging digital distribution to disrupt cost structures.

And in a strategic re-entry into India’s insurance sector, Allianz has partnered with Jio Financial Services to launch a 50:50 reinsurance venture—marking a potential challenge to public-sector players like GIC Re.

Triggers To Watch

Q2 earnings are expected in mid-October, and Pal advised investors to watch for performance in margins, loan growth, or any new guidance that could act as a crucial short-term catalyst.

What Is The Retail Mood?

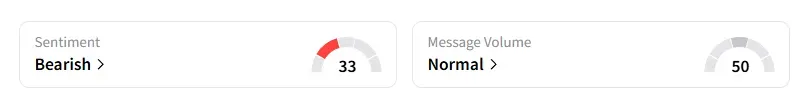

Data on Stocktwits shows that retail sentiment turned ‘bearish’ on the counter a day ago.

Jio Financial shares have risen a little over 4% year-to-date (YTD).

For updates and corrections, email newsroom[at]stocktwits[dot]com.

/filters:format(webp)https://news.stocktwits-cdn.com/large_stock_price_bitcoin_OG_jpg_d43a7edd5e.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/Prabhjote_DP_67623a9828.jpg)

/filters:format(webp)https://news.stocktwits-cdn.com/Getty_Images_2227994915_jpg_357c625963.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/IMG_8805_JPG_6768aaedc3.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_1470886126_jpg_f11dd80298.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/IMG_4530_jpeg_a09abb56e6.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2262161352_jpg_832967dbca.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/IMG_9209_1_d9c1acde92.jpeg)

/filters:format(webp)https://news.stocktwits-cdn.com/large_bitcoin_OG_oct23_jpg_588046d0a9.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_patrick_soon_shiong_jpg_5f4d6bc18d.webp)