Advertisement|Remove ads.

Parsons Stock On Track For Worst Day Ever After Losing Out On Lucrative Federal Contract

- The overall size of the entire contract could touch $32.5 billion.

- As the prime integrator, Peraton will oversee a team of subcontractors to replace core infrastructure, including telecommunications networks and radar systems.

- U.S. officials said that Pearson’s capabilities align with the administration’s goal of fundamentally overhauling the air traffic control system.

Parsons Corp. (PSN) stock plunged over 25% on Friday, after rival Peraton nabbed a multi-billion-dollar air traffic control contract from the U.S. Federal Aviation Administration (FAA) and the Department of Transportation (DOT).

If losses hold, the stock is heading toward its biggest single-day percentage decline ever.

Why Was The Contract Important?

The U.S. aviation industry has often faced challenges with ageing telecommunications equipment, as seen in airports in Newark and Dallas this year. To address the problems, President Donald Trump’s signature spending bill approved $12.5 billion to overhaul the entire system. However, the two federal government bodies said on Thursday that they require an additional $20 billion to complete the overhaul.

“Peraton’s capabilities are aligned with President Trump’s goal to fundamentally overhaul air traffic control for the better. The company’s expertise with integrating complex tech platforms and successful collaboration with federal government agencies have positioned them well to execute on this ambitious timeline,” FAA and DOT officials said.

As the prime integrator, Peraton will oversee a team of subcontractors to replace core infrastructure, including telecommunications networks and radar systems.

As per a factsheet provided by the FAA, the overhaul would require 44 airports with new replacement surface radars, 200 airports with surface awareness initiative surveillance technology, and 89 airports will get new terminal flight data manager tools.

What Are Analysts Saying?

As per TheFly, Raymond James analyst Brian Gesuale double-downgraded Parsons to ‘Market Perform’ from ‘Strong Buy.’ The firm noted that Peraton's award "will be a major surprise" to Parsons investors, and development erases "significant" organic upside to 2026 and 2027 estimates.

The analysts also noted that the stock's 35% premium to peers on expectations of the contract win could be cut in half or more as share catalysts "become less in magnitude and more ambiguous from a timing standpoint."

Truist analysts also issued similar concerns. The firm reportedly said that while Parsons should be a "winner" in the Big Beautiful Bill funding cycle, the company has less defined catalysts now and could need meaningful, tangible wins.

What Are Stocktwits Users Thinking?

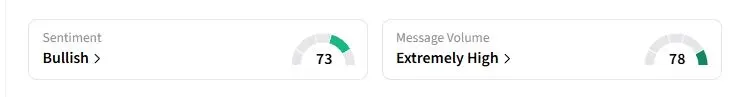

Retail sentiment on Stocktwits about Parsons, however, moved to ‘bullish’ territory from ‘bearish’ a day ago, at the time of writing.

Including the session’s losses, Parsons’ stock has fallen by more than 31% this year.

Also See: What Is A Moving Average?

For updates and corrections, email newsroom[at]stocktwits[dot]com.

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2228875477_jpg_4c76a2e8b7.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/vivekkrishnanphotography_58_jpg_0e45f66a62.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2213365850_jpg_470b9c6c06.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/Rounak_Author_Image_7607005b05.png)

/filters:format(webp)https://news.stocktwits-cdn.com/large_michael_saylor_strategy_2013_resized_jpg_e358c15fd4.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/Prabhjote_DP_67623a9828.jpg)

/filters:format(webp)https://news.stocktwits-cdn.com/large_lithium_47e0215e10.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_evolent_jpg_3c3f2aa8e5.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2250655281_jpg_c8c0e9352f.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/shivani_photo_jpg_dd6e01afa4.webp)