Advertisement|Remove ads.

J&K Bank confident of 12% credit growth, to maintain margins above 3.6%, says CEO Amitava Chatterjee

On asset quality, Amitava Chatterjee, Managing Director and Chief Executive Officer at J&K Bank said the gross non-performing assets (NPA) ratio has continued to decline. “The NPA has further gone down… we are sticking to our guidance of below 3% for the year,” he said.

Jammu & Kashmir Bank expects to meet its full-year credit growth guidance of 12%, supported by strong performance in its retail and agriculture portfolios, according to Amitava Chatterjee, Managing Director and Chief Executive Officer.

He added that what he had earlier expected to happen in the third quarter “has already happened in the second” due to “very good retail growth.”

He said the bank’s growth in the second quarter was driven entirely by the retail and agriculture segments, despite challenges in Jammu and Kashmir. “Our bank is primarily retail-focused. So there has been a very good growth in agri as well as retail,” he said.

Chatterjee noted that loan growth outside J&K has picked up faster than expected. “The rest of India retail has picked up substantially during this quarter,” he said. “First quarter growth had happened in J&K; second quarter almost the entire growth has happened from the rest of India.”

Also Read | Protection and retirement segments to drive future growth: Canara HSBC Life’s Anuj Mathur

On profitability, the CEO said the bank is aiming to maintain its net interest margins (NIMs) above 3.6%, even as cost pressures persist. “In the first quarter, we managed to retain a margin of 3.7 plus,” he said. “There has been a little bit of pressure on the cost of funds, but I am very hopeful that we will be able to maintain the margins above 3.6.”

He said the higher cost of funds was mainly due to an increase in term deposits, though the current account/savings account (CASA) ratio has started improving. “First quarter was a very bad quarter as far as CASA was concerned. We had a degrowth, but fortunately, we had a growth in CASA in the second quarter,” Chatterjee said. He added that the bank is opening more accounts in the rest of India to strengthen its CASA base.

Jammu & Kashmir Bank Ltd. on Monday, October 6, said its total business rose 9.89% year-on-year to ₹2,57,196 crore (provisional) in the second quarter of FY26.

On asset quality, Chatterjee said the gross non-performing assets (NPA) ratio has continued to decline. “The NPA has further gone down… we are sticking to our guidance of below 3% for the year,” he said.

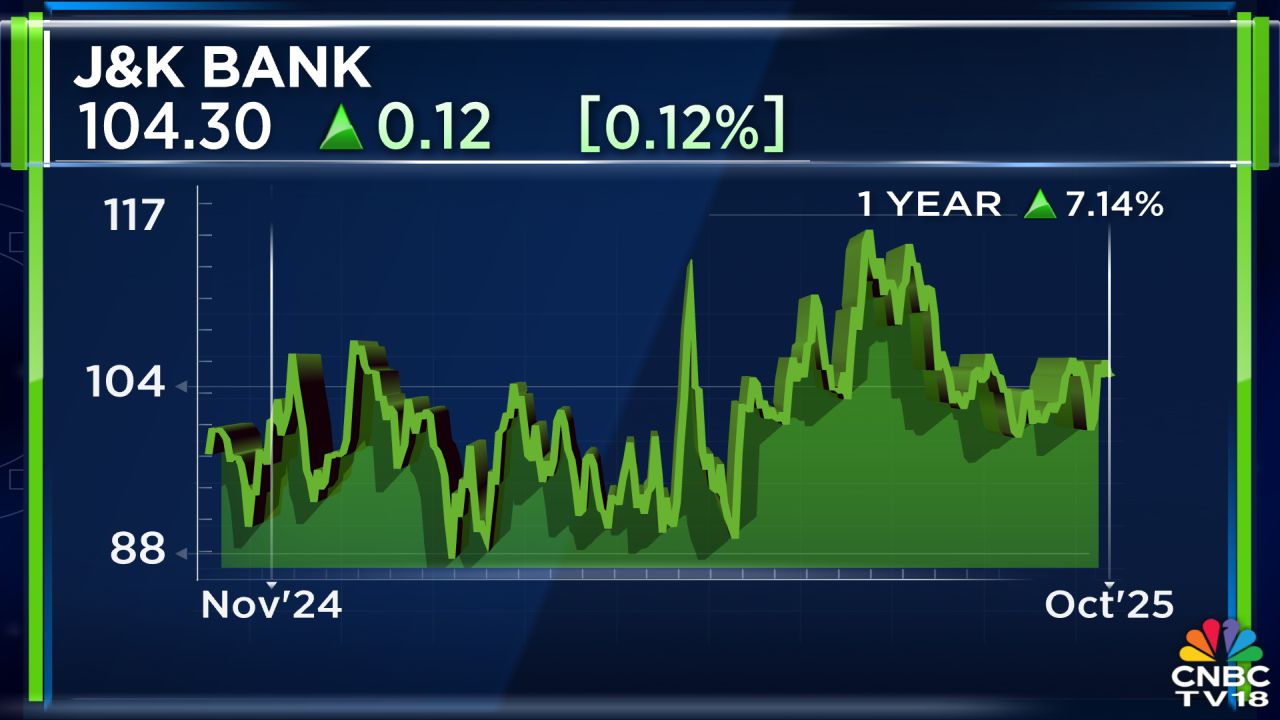

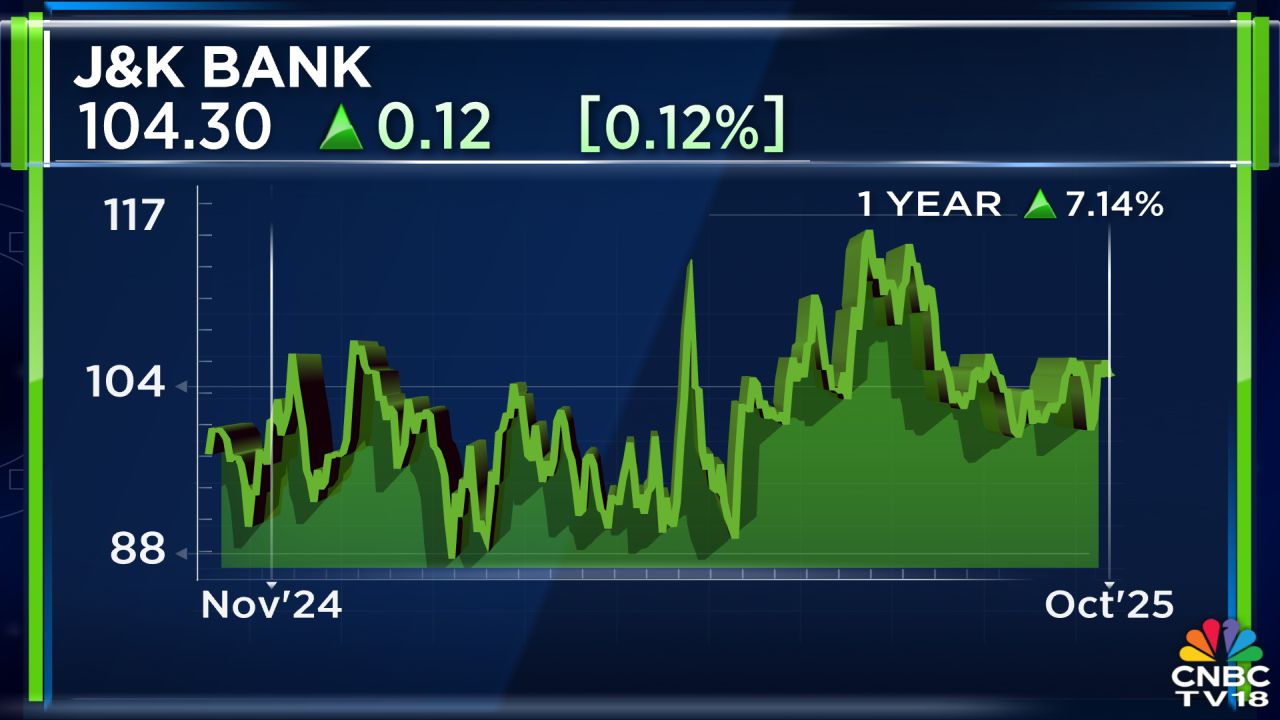

J&K Bank, which has a market capitalisation of ₹11,474.32 crore, has seen its shares rise over 7% in the past year.

For the full interview, watch the accompanying video

Catch all the latest updates from the stock market here

He added that what he had earlier expected to happen in the third quarter “has already happened in the second” due to “very good retail growth.”

He said the bank’s growth in the second quarter was driven entirely by the retail and agriculture segments, despite challenges in Jammu and Kashmir. “Our bank is primarily retail-focused. So there has been a very good growth in agri as well as retail,” he said.

Chatterjee noted that loan growth outside J&K has picked up faster than expected. “The rest of India retail has picked up substantially during this quarter,” he said. “First quarter growth had happened in J&K; second quarter almost the entire growth has happened from the rest of India.”

Also Read | Protection and retirement segments to drive future growth: Canara HSBC Life’s Anuj Mathur

On profitability, the CEO said the bank is aiming to maintain its net interest margins (NIMs) above 3.6%, even as cost pressures persist. “In the first quarter, we managed to retain a margin of 3.7 plus,” he said. “There has been a little bit of pressure on the cost of funds, but I am very hopeful that we will be able to maintain the margins above 3.6.”

He said the higher cost of funds was mainly due to an increase in term deposits, though the current account/savings account (CASA) ratio has started improving. “First quarter was a very bad quarter as far as CASA was concerned. We had a degrowth, but fortunately, we had a growth in CASA in the second quarter,” Chatterjee said. He added that the bank is opening more accounts in the rest of India to strengthen its CASA base.

Jammu & Kashmir Bank Ltd. on Monday, October 6, said its total business rose 9.89% year-on-year to ₹2,57,196 crore (provisional) in the second quarter of FY26.

On asset quality, Chatterjee said the gross non-performing assets (NPA) ratio has continued to decline. “The NPA has further gone down… we are sticking to our guidance of below 3% for the year,” he said.

J&K Bank, which has a market capitalisation of ₹11,474.32 crore, has seen its shares rise over 7% in the past year.

For the full interview, watch the accompanying video

Catch all the latest updates from the stock market here

Read about our editorial guidelines and ethics policy

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/large_stock_rising_resized_f17852d7aa.jpg)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/unnamed_jpg_9dff551b50.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_iren_OG_jpg_ba842dd11a.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/shivani_photo_jpg_dd6e01afa4.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/large_Stock_chart_trending_march_jpg_ad3a86ed42.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/Rounak_Author_Image_7607005b05.png)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Bitcoin_new_b2128e67d9.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/Prabhjote_DP_67623a9828.jpg)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/large_Kellanova_Image_0c708f8e9a.jpg)

/filters:format(webp)https://news.stocktwits-cdn.com/IMG_4530_jpeg_a09abb56e6.webp)