Advertisement|Remove ads.

JP Power Surges On Adani Deal Speculation: SEBI RAs Flag Bullish Trend, Key Levels To Watch

Jaiprakash Power Ventures (JP Power) surged nearly 18% in intraday trading on Monday, marking the second consecutive session of gains. The rally followed media reports that the Adani Group, led by billionaire Gautam Adani, has emerged as the top bidder to acquire Jaiprakash Associates (JP Associates).

SEBI-registered analyst Vinayak Gautam highlighted that a potential acquisition by the financially robust and professionally managed Adani Group is seen as a positive development, not just for JP Associates but also for JP Power, in which JP Associates holds a 24% stake.

Analyst Palak Jain observed that JP Power stock has seen notable support at ₹20 and resistance near ₹23. She added that a break above the highlighted resistance could lead to further upward momentum, while failure to hold above support may trigger selling conditions.

Its price-to-earnings growth (PEG) ratio stands at 0.18, indicating potential undervaluation. Jain also noted that, despite the company's healthy debt-to-equity ratio of 0.31, key risks to monitor include market volatility and regulatory changes.

Overall, she believes that the stock presents growth opportunities amid underlying profitability challenges.

The company reported a sharp decline of over 73% in net profit to ₹155.67 crore for the March 2025 quarter, primarily due to lower income. In comparison, it had recorded a net profit of ₹588.79 crore during the same quarter of the previous fiscal (Q4 FY24), according to its exchange filing.

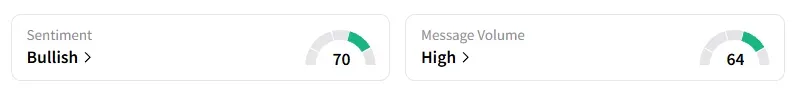

Data on Stocktwits shows that retail sentiment is ‘bullish’ on this counter amid ‘high’ message volumes.

JP Power shares have gained 23% year-to-date (YTD).

For updates and corrections, email newsroom[at]stocktwits[dot]com.

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/large_adam_smigielski_K5m_Pt_O_Nmp_HM_unsplash_f365ee93f4.jpg)

/filters:format(webp)https://news.stocktwits-cdn.com/jaiveer_jpg_280ad67f36.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_trump_jpg_fc59d30bbe.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Aashika_Suresh_Profile_Picture_jpg_2acd6f446c.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_1190665957_jpg_92088206ed.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2235337192_jpg_56c00409cf.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/unnamed_jpg_9dff551b50.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_marvell_logo_OG_jpg_dfc748dd9b.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2232147590_jpg_a31aecbfad.webp)