Advertisement|Remove ads.

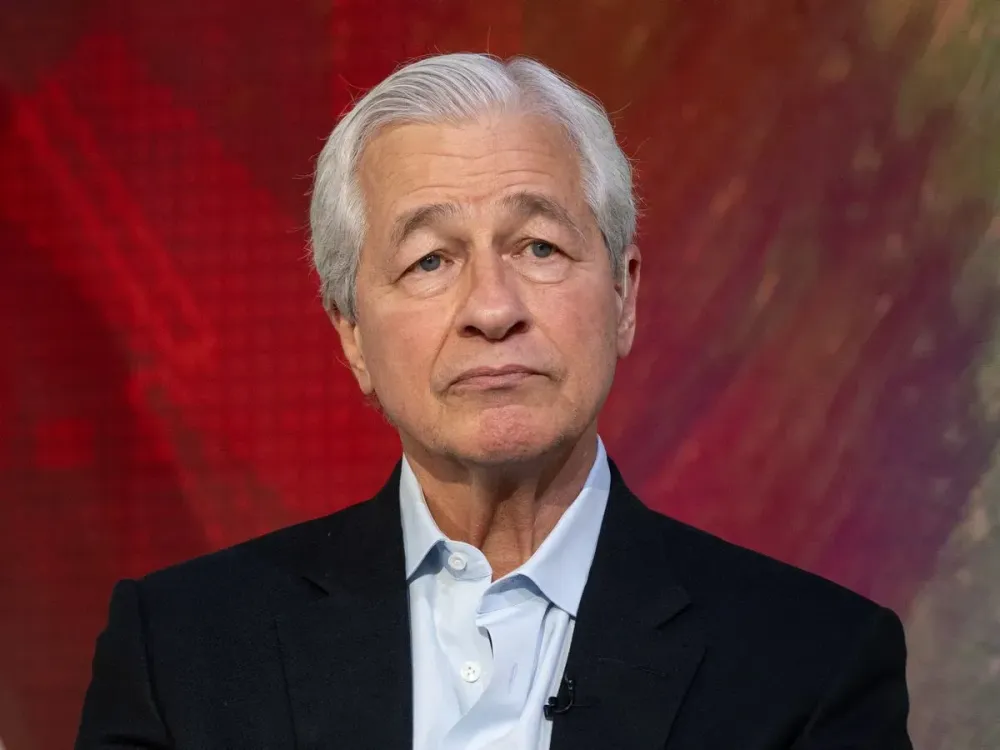

JPMorgan’s Jamie Dimon Warns Of ‘Extraordinary’ Complacency As Markets Recoup ‘Liberation Day’ Losses

JPMorgan Chase CEO Jamie Dimon warned that the markets are experiencing complacency after U.S. equities recouped their “Liberation Day” losses.

“The market came down 10%, back up 10%. I think that's an extraordinary amount of complacency,” he said, according to a Yahoo Finance report, based on the bank’s annual Investor Day event.

Dimon expressed concerns about the impact of President Donald Trump’s tariffs.

The Trump administration announced a 90-day pause on tariffs on most countries weeks after the President’s “Liberation Day” announcement.

More recently, the U.S. struck a trade deal with the U.K., and the Trump administration dialed down tariffs on Chinese goods to 30% for a 90-day period.

That is not enough for Dimon, yet. He noted that the full impact of Trump’s tariffs on the economy is not apparent yet, even as some analysts expressed optimism about the outlook for U.S. equities.

Dimon thinks Trump’s tariffs are still “pretty extreme.” The veteran banker highlighted the threat posed by the risk of stagflation and inflation—he thinks the odds of stagflation are “probably two times” what the market expects.

Earlier, JPMorgan’s CFO highlighted uncertainty in the economic outlook due to an evolving tariff policy and geopolitical risks.

This follows the outlook of the Federal Open Market Committee, which underscored an increased risk of higher unemployment and higher inflation.

Earlier last week, Citigroup CEO Jane Fraser expressed concerns, saying investors looking to the markets for clarity could be a “tad disappointed.”

“But if you're looking for signals, they're everywhere. Treasury yields rose even as equity markets wobbled. The U.S. dollar, typically a safe haven, has weakened at moments when it used to rally. That tells us something deeper is going on,” she said in a blog post.

Meanwhile, the SPDR S&P 500 ETF Trust (SPY) was down by 0.07%, while Invesco QQQ Trust (QQQ) fell 0.15%.

For updates and corrections, email newsroom[at]stocktwits[dot]com.

Also See: Nvidia CEO Jensen Huang Calls Trump’s China Chip Ban ‘Deeply Painful,’ Says It Cost $15B In Sales

/filters:format(webp)https://news.stocktwits-cdn.com/Getty_Images_2231786698_jpg_4d7b65921f.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/shivani_photo_jpg_dd6e01afa4.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_federal_reserve_jpg_92efa5a8c7.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Aashika_Suresh_Profile_Picture_jpg_2acd6f446c.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/large_Visa_resized_82d951e81e.jpg)

/filters:format(webp)https://news.stocktwits-cdn.com/Anushka_Basu_make_me_smile_in_the_picture_b92832aa_af59_4141_aacc_4180d2241ba8_1_2_png_1086e0ed8c.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_1218279776_jpg_d381694a09.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/vivekkrishnanphotography_58_jpg_0e45f66a62.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2199360480_jpg_41abd97106.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Palantir_jpg_d29fd424cd.webp)