Advertisement|Remove ads.

Walmart A ‘Must-Own’ Stock — Wall Street Analysts Raise Price Targets After Solid Q3 Results

- Walmart reported strong third-quarter results and raised its outlook for the current year, sending WMT 6.5% higher on Thursday.

- Analysts also praised its aggressive price posture and gains in non-core areas, such as advertising.

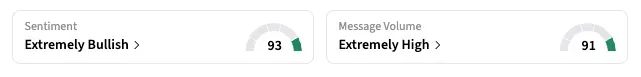

- Stocktwits sentiment shifted to ‘extremely bullish’ from ‘bullish,’ with the WMT ticker trending among the top 10 on the platform.

At least three analysts raised their price targets on Walmart, Inc.’s stock on Thursday following the retail chain’s strong quarterly results and outlook raise.

Wells Fargo raised its target to $120 from $110, while JPMorgan raised its target by $1 to $129 and Truist raised its target by $10 to $119, according to summaries of price actions on The Fly.

Walmart shares closed 6.5% higher at $107.11 on Thursday, the stock’s best single-day performance since April.

What Do Analysts Say?

Walmart’s solid print eased investor worries about consumer spending, JPMorgan analysts said in their note. The company’s commitment to accelerating earnings after the surprise CEO change announced last week, and its aggressive price posture as grocery inflation cools, reinforce the bull case for the shares.

Truist analysts said they expect strong trends to continue in the fourth quarter and 2026, based on sales momentum “across the board” in Q3. Also noting growth in non-core areas, such as advertising, they called WMT "a must-own for growth investors."

What Drove Walmart’s Results And Outlook?

The nation’s largest retail store chain raised its revenue and adjusted profit outlook for its current fiscal year that ends in January 2026, after reporting third-quarter results above Wall Street’s targets.

Total revenue rose 5.8% to $179.5 billion, beating analysts’ expectations of $175.2 billion. The company earned $0.62 per share on an adjusted basis, also higher than the $0.60 per share estimate.

Walmart management noted softer spending among lower-income shoppers and increased purchases from higher-income customers. Still, the retailer’s low prices, broad assortment, and strong value offerings continued to draw shoppers across income levels.

Prices at Walmart stores increased by 1.3% over the quarter, with the largest increases in import categories such as electronics and patio furniture.

Retail’s View

On Stocktwits, the retail sentiment for WMT shifted to ‘extremely bullish’ (93/100) as of late Thursday, from ‘bullish’ the previous day, with the ticker among the top 10 trending tickers on the platform. A retail user called it “obviously the safest play.”

With Thursday’s gains, the WMT stock is up 18.6% year-to-date.

For updates and corrections, email newsroom[at]stocktwits[dot]com.

/filters:format(webp)https://news.stocktwits-cdn.com/large_janetyellen_resized_jpg_ea2c28f284.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/jaiveer_jpg_280ad67f36.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Jamie_Dimon_July_736ff90d31.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Aashika_Suresh_Profile_Picture_jpg_2acd6f446c.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2207049226_jpg_7f1e685123.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2218181377_jpg_f2dccc3db9.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2245017747_jpg_f783731632.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/unnamed_jpg_9dff551b50.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_China_i_Phone_jpg_bcedab655a.webp)