Advertisement|Remove ads.

GAP Stock Eyes Return To The Green This Year As Viral Denim Campaign Delivers Sydney Sweeney-Style Lift For Q3

- Gap reported third-quarter sales and profit that surpassed analysts’ expectations.

- The apparel retailer said its “Better in Denim” boosted store traffic and denim sales.

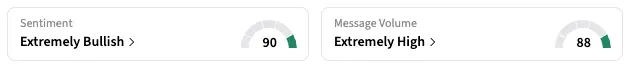

- Stocktwits sentiment for GAP flips to ‘extremely bullish’ from ‘bearish.’

Fashion retailer Gap, Inc. got a boost from its “Better in Denim” campaign last quarter, joining fellow brand American Eagle in reviving sales with the help of viral commercials.

Shares of Gap jumped 5.6% in after-hours trading on Thursday, after the company reported third-quarter results above expectations and boosted its full-year outlook. If the move holds in Friday’s session, the stock could bounce back in the green for the year.

‘Better In Denim’

The denim campaign, featuring the girl group Katseye dancing in low-rise Gap jeans to Kelis’ “Milkshake,” went viral, with fans praising the choreography and the cross‑generational appeal. It has drawn 8 billion impressions and 500 million views since its launch in August, Gap said.

“Better in Denim culminated in a global cultural takeover and has become one of the brand's most successful campaigns to date, generating significant traffic and double-digit growth in denim,” CEO Richard Dickson said on the analyst call.

He added: “It's (Gap’s) a brand that knows who it is, where it's going and how to win. And we're looking forward to carrying that momentum into the holiday season.”

More Social Currency Over AEO?

Gap’s “Better in Denim” campaign launched just a month after American Eagle’s viral ads starring actress Sydney Sweeney. The "Sydney Sweeney Has Great Jeans" campaign, along with the launch of a branded collection with footballer Travis Kelce, attracted 700,000 new customers to the American Eagle brand, the company said in September.

Although the Sweeney ad gained widespread attention, it sparked controversy over wordplay (“jeans” allegedly used to mean “genes”) that some critics saw as a reference to eugenics. On the other hand, fans largely praised Gap’s ad for its positive and inclusive tone.

Results And Forecast

In the third quarter, Gap’s net sales rose 5% to $3.94 billion, beating analysts’ consensus estimates of $3.83 billion. Comparable sales rose 5%, beating expectations of a 3.1% growth.

Comparable sales for Old Navy, the company’s biggest brand, climbed 6%, while Gap posted a 7% increase. Banana Republic’s comparable sales increased 4%, while those of the athletic label Athleta declined 11%.

The company said back-to-school and early holiday purchases powered the sales momentum.

Adjusted profit declined to $0.62 per share from $0.72 per share in the year-ago quarter, but came in higher than expectations of $0.53 per share.

Gap, consequently, raised its fiscal-year operating margin outlook to around 7.2%, up from its previous range of 6.7% to 7%, and said it expects net sales growth in the high end of its previously forecast range of 1.7% to 2%. Gap’s fiscal year will end in February 2026.

Retail Turns Extremely Bullish

On Stocktwits, the retail sentiment for GAP flipped to ‘extremely bullish’ as of late Thursday, from ‘bearish’ the prior day. Notably, the after-market rally in shares comes after they declined in five of the last six sessions.

As of the last close, the GAP stock was down 2.4% year-to-date.

For updates and corrections, email newsroom[at]stocktwits[dot]com.

Read Next: Walmart A ‘Must-Own’ Stock — Wall Street Analysts Raise Price Targets After Solid Q3 Results

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_1813801150_jpg_9e452258fa.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Anushka_Basu_make_me_smile_in_the_picture_b92832aa_af59_4141_aacc_4180d2241ba8_1_2_png_1086e0ed8c.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2190302521_jpg_796f64970e.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2194612888_1_jpg_5f7b7f6186.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_1384896168_jpg_87fab3f04d.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2263571605_jpg_f769289486.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2233719278_jpg_46dfac21ee.webp)