Advertisement|Remove ads.

JPMorgan Q4 Earnings Preview: Wall Street Expects Higher Earnings, Solid Investment Banking Revenue

Shares of JPMorgan were in the spotlight on Monday morning as investors digested CEO Jamie Dimon’s remarks in a CBS interview and prepared for the bank’s fourth-quarter earnings scheduled on Wednesday.

The bank is expected to report earnings per share (EPS) of $4.03 on revenue of $41.58 billion, according to FinChat. According to Stocktwits data, the lender has topped Wall Street expectations in the last three quarters.

Morgan Stanley expects the lender to report above-consensus earnings, supported by higher fee income, lower share count, higher NII, lower provision, and lower expenses.

The brokerage sees JPMorgan benefiting from the ongoing capital markets with investment banking revenues up 47% year-over-year (YoY) and strong trading growth of 16% YoY.

Although the brokerage’s 2025 expense estimate of $96.6 billion is over $1 billion above consensus, it believes a stronger-than-expected net interest income (NII) and fees will drive a 2025 expense ratio of 54%, better than the Street's estimate of 55.5%.

Meanwhile, CEO Jamie Dimon has reportedly indicated there is a chance he might become the bank’s chair at an appropriate time if the board consents. "Oh, that's likely. That's likely to happen. Again, that is up to the board, not up to me. But if it makes sense, I may be chairing for a couple (of) years,” Dimon told CBS.

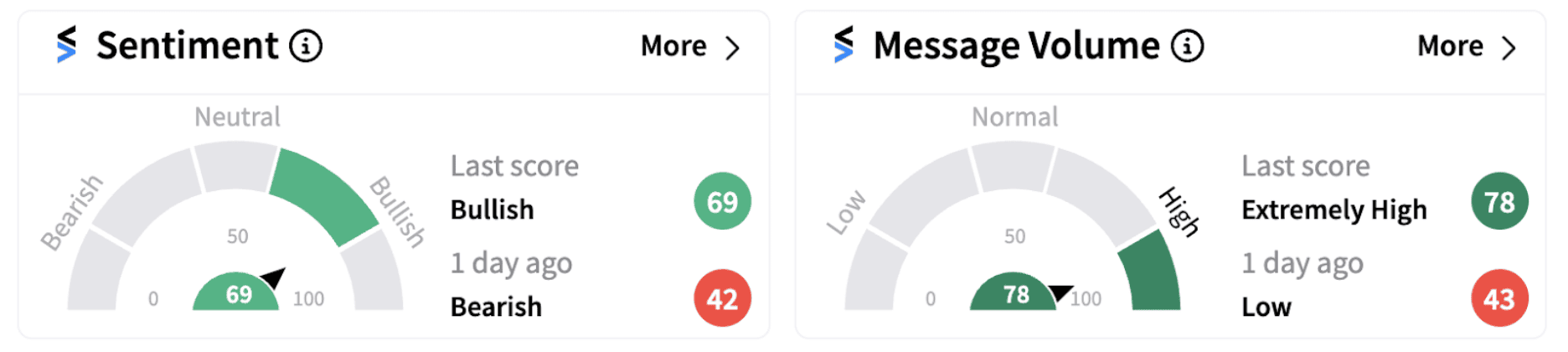

Ahead of the earnings, retail sentiment on Stocktwits jumped into the ‘bullish’ territory (69/100) from ‘bearish’ a day ago, accompanied by ‘extremely high’ retail chatter.

Meanwhile, retail chatter on Stocktwits ahead of earnings indicates a positive take on the stock.

Shares of the lender have gained over 42% over the past year.

The fourth-quarter earnings season is set to gather pace this week, with most major banks scheduled to report their earnings over the next few days.

JPMorgan Chase, Wells Fargo, Citigroup, Goldman Sachs, Bank of America and Morgan Stanley are the big names scheduled to announce their quarterly report.

Some other names include Bank of New York Mellon, U.S. Bancorp, Independent Bank and M&T Bank.

Also See: Stocktwits Poll: Retail Investors Bet RR Stock Will Have Most Upside In 2025 Among Robotics Players

For updates and corrections, email newsroom[at]stocktwits[dot]com.

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2250241035_jpg_937df85f43.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/unnamed_jpg_9dff551b50.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_kashkari_original_jpg_b7db42a385.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Aashika_Suresh_Profile_Picture_jpg_2acd6f446c.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2199401088_jpg_656c1eacd4.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/vivekkrishnanphotography_58_jpg_0e45f66a62.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_1236271712_jpg_16001d2299.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Figma_jpg_4536c33786.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2219201717_1_jpg_a4257a5acc.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/shivani_photo_jpg_dd6e01afa4.webp)