Advertisement|Remove ads.

JPMorgan’s Asset Management Division Launches US Research Enhanced Large Cap ETF: Retail’s Positive

JPMorgan Chase & Co (JPM) said on Friday that its asset management division has launched the JPMorgan U.S. Research Enhanced Large Cap ETF (JUSA) on the New York Stock Exchange.

According to J.P. Morgan Asset Management, JUSA offers a distinctive approach to U.S. equity exposure by utilizing proprietary research and concentrating on well-established, large-cap U.S. companies.

The company said the fund is managed by portfolio managers Ralph Zingone and Tim Snyder, who bring extensive expertise in managing research-enhanced strategies.

It explained that JUSA is designed with a slightly lower active risk budget and a more significant number of holdings, providing broader diversification. “This makes it an attractive option for investors looking for consistent returns in their U.S. equity exposure,” the firm said.

The company has been implementing the underlying strategy since 1988, it added.

On Thursday, Morgan Stanley lowered its price target on JPMorgan to $275 from $278 while keeping an ‘Equal Weight’ rating on the shares.

According to TheFly, Morgan Stanley said the robust capital markets rebound it expected in 2025 is not playing out as anticipated. The firm is lowering its estimates for investment banking revenues due to recent market conditions, as volatility likely pushes out deal launches.

However, the brokerage noted that large-cap bank and mid-cap advisor stocks "appear oversold against our new base case.”

Earlier this week, Bank of America, too, lowered its price target on JPMorgan to $285 from $300 while keeping a ‘Buy’ rating on the shares.

According to TheFly, the brokerage lowered price targets among its banks coverage by 6% on average, led by worsening growth and a rising cost of capital.

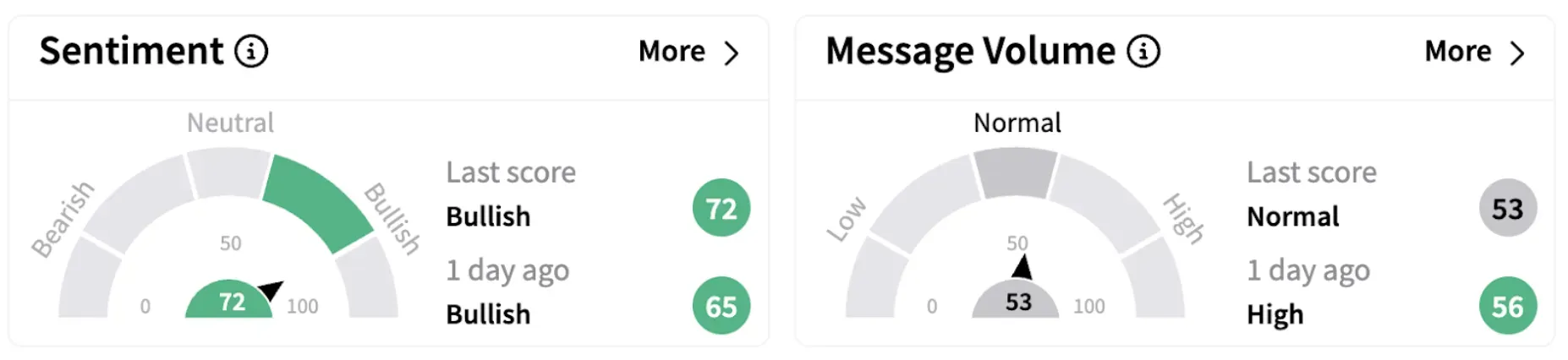

Meanwhile, on Stocktwits, retail sentiment surrounding JPM stock climbed further into ‘bullish’ territory (72/100).

JPMorgan shares traded over 3% higher on Friday. The stock is down over 3% in 2025 but has gained over 23% in the past 12 months.

For updates and corrections, email newsroom[at]stocktwits[dot]com.

/filters:format(webp)https://news.stocktwits-cdn.com/large_Tether_2376a55503.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Anushka_Basu_make_me_smile_in_the_picture_b92832aa_af59_4141_aacc_4180d2241ba8_1_2_png_1086e0ed8c.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_robert_kiyosaki_d28a01cb4b.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Bitcoin_and_Ethereum_2b4356b70a.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_976546456_jpg_42ddd4a81d.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2259655311_jpg_20124bbeb9.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Donald_Trump_451371e34e.webp)