Advertisement|Remove ads.

JSW Infrastructure Preview: Q1 Results Could Fuel Next Rally, Says SEBI RA Rohit Mehta

JSW Infrastructure is showing promising momentum on the charts ahead of its quarterly earnings scheduled later in the day.

JSW Infrastructure stock recently broke out of a rounded bottom formation near the ₹270 zone and is now forming higher lows, a sign of accumulation, as observed by SEBI-registered analyst Rohit Mehta.

A sustained hold above the ₹275 - ₹285 support zone, along with consolidation above ₹310, could lead to a potential rally toward its all-time high of ₹359, especially if earnings provide a positive trigger, Mehta added.

Investors are hopeful that the company’s Q1 FY26 results will align with its bullish technical setup.

In Q4FY25, JSW Infrastructure reported a 17.1% growth in sales, while profit before tax jumped 39.3% YoY. EPS more than doubled on a sequential basis. With a 5-year profit CAGR of 51.5%, JSW Infra has strong growth credentials, though concerns linger about possible interest expense capitalization.

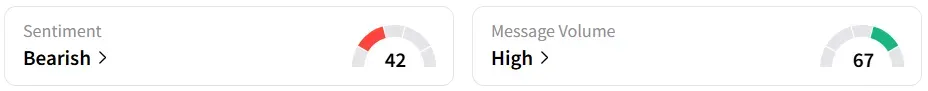

However, retail sentiment on Stocktwits remained ‘bearish’ amid ‘high’ message volumes. It was ‘neutral’ a week ago.

While the stock has gained over 5% in the past month, it has declined 0.6% year-to-date.

For updates and corrections, email newsroom[at]stocktwits[dot]com

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2264020227_jpg_4d7420bef3.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Anushka_Basu_make_me_smile_in_the_picture_b92832aa_af59_4141_aacc_4180d2241ba8_1_2_png_1086e0ed8c.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2259210190_jpg_d48bbe3269.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_1396534113_jpg_b0e09f299b.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Jane_Street_3ac3fb6443.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Truth_social_5bfbc7389b.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2221283194_jpg_8178c730a4.webp)