Advertisement|Remove ads.

JSW Steel Stock Charts Signal More Upside; SEBI Analyst Flags Key Levels To Watch

JSW Steel shares have gained nearly 20% so far this year. And in the past few sessions, the charts have shown strong bullish momentum with price trading above short-term and medium-term moving averages.

SEBI-registered analyst Deepak Pal highlighted that its Relative Strength Index (RSI) stands around 64, indicating strength but not yet in overbought territory. And the Moving Average Convergence Divergence (MACD) has turned positive, supporting bullish momentum.

He identified immediate support at ₹1,050–₹1,040, with resistance placed at ₹1,100–₹1,115. Sustaining above ₹1,080 could open the path towards ₹1,125–₹1,150 levels in the short term for JSW Steel stock.

What’s Working For JSW Steel?

JSW Steel is one of India’s largest steel producers with a diversified product mix (flat & long steel products). Pal noted that the company has reported stable revenue growth, though margins remain cyclical with raw material price fluctuations (iron ore & coking coal).

While JSW Steel has high capex in capacity expansion, its strong cash flows support balance sheet stability. However, Pal cautioned that the stock was trading at a fair-to-slight premium valuation compared to peers, backed by demand visibility.

Next Triggers To Watch

He believes that the government’s infrastructure spending plans will be positive for steel demand going ahead. Additionally, JSW Steel’s ongoing capacity expansion (Dolvi & Vijayanagar projects) will enhance future earnings visibility.

Keep an eye on anti-dumping duties or export restrictions that can affect exports. And any improvement in EBITDA margins & demand outlook in the upcoming results can further fuel upside for the stock.

What Is The Retail Mood?

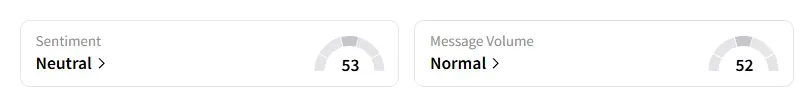

Data on Stocktwits shows that retail sentiment turned from ‘bearish’ to ‘neutral’ a day ago on this counter.

For updates and corrections, email newsroom[at]stocktwits[dot]com.

/filters:format(webp)https://news.stocktwits-cdn.com/large_ras_tanura_jpg_b79d6fe085.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/IMG_8805_JPG_6768aaedc3.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Getty_Images_2202580632_jpg_9b97227b1a.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Aashika_Suresh_Profile_Picture_jpg_2acd6f446c.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_ACHR_resized_jpg_25097dbec7.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/jaiveer_jpg_280ad67f36.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Plug_resized_jpg_82cf2f0bcd.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/astspacemobile_resized_jpg_8a6aa92413.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2231279747_jpg_9150b71435.webp)