Advertisement|Remove ads.

Jumia Shares Jump As Axian Mulls Buyout of E-Commerce Giant: Report

Jumia Technologies AG (JMIA), Africa’s largest online retail platform, has reportedly attracted acquisition interest from Axian Telecom, a Mauritius-based telecom provider with a focus on the African market.

According to a Bloomberg report, sources familiar with the discussions say Axian recently secured $600 million in funding, earmarked in part to support a potential purchase of Jumia.

Jumia Technologies stock traded over 7% higher on Tuesday morning after the report.

While Axian has been increasing its stake in Jumia, reaching 8% ownership as of May, sources caution that negotiations are ongoing and may not result in a finalized agreement.

Jumia, listed on the New York Stock Exchange, currently has a market valuation of nearly $500 million. The deal, if completed, could result in Jumia being taken private, the report suggested.

Jumia, which launched in Nigeria in 2012, became Africa’s first startup to surpass a $1 billion valuation. Although it went public on the New York Stock Exchange in 2019, the company’s share price has dropped notably in the years that followed.

Jumia Technologies stock has gained over 12% year-to-date and has lost over 39% in the past 12 months.

In a bid to streamline operations and improve margins, Jumia recently moved senior leadership from Dubai to its core African offices.

Recently, the company said a growing number of Chinese merchants are turning to it as trade barriers with the U.S. prompt exporters to explore alternative markets.

CEO Francis Dufay stated that the platform hosted roughly 12,000 global vendors, mainly from China, who are responsible for around one-third of all items sold.

In 2024, Jumia posted $167.5 million in revenue and served 5.4 million customers across the continent.

In the first quarter (Q1) of 2025, Jumia Technologies’ revenue plunged 26% year-on-year (YoY) to $36.3 million, missing the analysts' consensus estimate of $39.24 million, as per FinChatt data.

The gross merchandise value (GMV) for Q1 declined 11% YoY to $161.7 million.

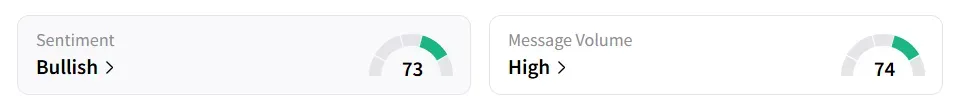

Following the announcement, retail sentiment shifted into the ‘bullish’ territory (73/100) from the ‘neutral’ zone amid ‘high’ levels of message volume.

Also See: Microsoft Strikes 5-Year Deal With Premier League To Bring AI-Powered Experience To Global Fans

For updates and corrections, email newsroom[at]stocktwits[dot]com.

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2262920033_jpg_f596c67fd3.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/jaiveer_jpg_280ad67f36.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Getty_Images_2231498932_jpg_bdd44fc548.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/unnamed_jpg_9dff551b50.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Getty_Images_2233516954_jpg_72241a7246.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Aashika_Suresh_Profile_Picture_jpg_2acd6f446c.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/large_AEHR_chip_maker_3698bf2343.jpg)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Trending_stock_resized_may_jpg_bc23339ae7.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/vivekkrishnanphotography_58_jpg_0e45f66a62.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2205870269_jpg_b38339787f.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/shivani_photo_jpg_dd6e01afa4.webp)