Advertisement|Remove ads.

Jupiter Wagons Stock Surges On ₹113 Crore Deal With Indian Railways; Retail Turns ‘Extremely Bullish’

Shares of Jupiter Wagons surged as much as 7.3% in early trade on Thursday after the company bagged a ₹113 crore order from the Ministry of Railways.

At the time of writing, the JWL's stock was trading 4.8% higher at ₹334.4.

In a press release on Wednesday, Jupiter Wagon’s subsidiary, Jupiter Tatravagonka Railwheel Factory, announced that it has received a Letter of Acceptance (LoA) from the Ministry of Railways for the supply of 9,000 LHB axles for FIAT-IR bogies.

Technical Take

On a 4-hour chart, the stock is showing strength with a crossover observed above the 50-day simple moving average (SMA), said SEBI-registered analyst Sunil Kotak.

Volume action is supportive, and the price action also reflects a positive trend, Kotak added.

Momentum has turned bullish, further reinforced by the relative strength index (RSI) crossing above the 60 mark.

On the downside, major support is placed in the ₹332 - ₹334 range, while the immediate supply zone is seen at ₹344 - ₹346. A sustained move beyond this supply zone could lead to further upside, the analyst said.

Stock Watch

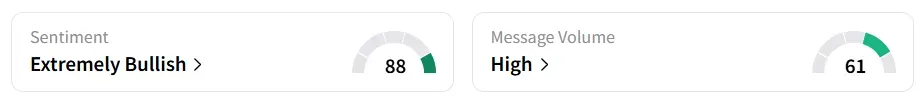

The deal has generated a strong buzz around the stock on Stocktwits. At the time of writing, Jupiter Wagons was among the top trending stocks on the platform.

Retail sentiment completely flipped to ‘extremely bullish’ from ‘bearish’ in the previous session.

On a year-to-date basis, the stock has been under pressure, losing over 32% of its value.

Peers, Texmaco Rail & Engineering was trading 0.85% higher, while Titagarh Rail Systems fell 0.45% on Thursday.

For updates and corrections, email newsroom[at]stocktwits[dot]com.

/filters:format(webp)https://news.stocktwits-cdn.com/large_tesla_robotaxi_jpg_ade25faaed.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/unnamed_jpg_9dff551b50.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Robotaxi_Tesla_jpg_209f017098.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/large_stock_price_fall_down_chart_representative_image_resized_08c968e73c.jpg)

/filters:format(webp)https://news.stocktwits-cdn.com/jaiveer_jpg_280ad67f36.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Michael_Burry_jpg_fa0de6ac92.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_uniqure_jpg_33b6552285.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Trending_stock_chart_jpg_3ff1b3a682.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/vivekkrishnanphotography_58_jpg_0e45f66a62.webp)