Advertisement|Remove ads.

KB Home Trims Annual Revenue Forecast Amid Housing Market Weakness: Retail Investors Keep Optimism

Homebuilder KB Home (KBH) trimmed its annual revenue forecast following second-quarter results that, while better than expected, still reflected ongoing softness in the U.S. housing market.

The company's shares dropped 1.3% in extended trading on Monday, while retail sentiment improved.

KB Home lowered its 2025 housing revenue guidance to $6.3 billion to $6.5 billion from $6.6 billion to $7 billion.

In the second quarter, revenue decreased to $1.53 billion year-over-year from $1.71 billion. Analysts were expecting $1.50 billion. Homes delivered decreased 11%, while the average selling price increased slightly to $488,700.

Adjusted profit reduced to $1.50 per share from $2.15 a year earlier. Analysts were expecting $1.46.

"Our team is producing improvements in two key areas, lowering our build times and reducing direct construction costs," said CEO Jeffrey Mezger, admitting that the "market conditions have softened."

He said the company has extensive land holdings and has decided to reduce land acquisition and development investments while increasing share repurchases.

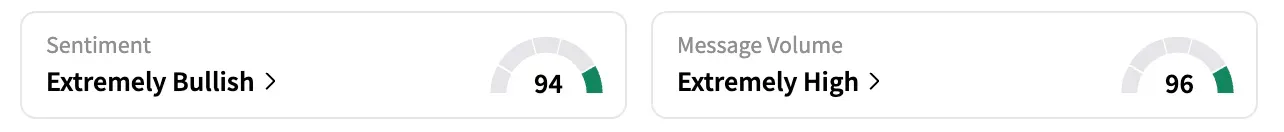

KB Homes shares are down nearly 20% year-to-date. On Stocktwits, the company's retail sentiment climbed a few notches higher into 'extremely bullish' territory.

A user said, "No brainer with that volume spike, time to build a long."

Last week, larger competitor Lennar Corp (LEN) reported its Q2 sales above expectations. The company said it managed to drive housing sales through price cuts and incentives, but that had a negative effect on profits.

For updates and corrections, email newsroom[at]stocktwits[dot]com.

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_1321753430_jpg_3be244e72e.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/IMG_4530_jpeg_a09abb56e6.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2261740807_jpg_19c077b8cd.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_uniqure_jpg_33b6552285.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/IMG_8805_JPG_6768aaedc3.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_changpeng_zhao_binance_CEO_OG_jpg_1f2a158765.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/Prabhjote_DP_67623a9828.jpg)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2263411662_jpg_efc7c78da8.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/IMG_9209_1_d9c1acde92.jpeg)

/filters:format(webp)https://news.stocktwits-cdn.com/large_immunitybio_jpg_eb6402d336.webp)