Advertisement|Remove ads.

KEI Industries Could See 10% Upside Above ₹3,900, Says SEBI RA Deepak Pal

KEI Industries is seeing renewed bullish momentum, supported by an 8% rally over the last two sessions.

At the time of writing, the KEI Industries shares were trading slightly lower at ₹3,876.30 on Wednesday.

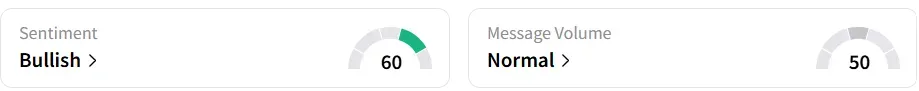

Retail sentiment has turned ‘bullish’ on Stocktwits, supported by the recent rally.

Based on the daily chart, the stock is consistently finding support near its previous day’s low and the 50-day moving average, which strengthens the technical setup for further gains, according to SEBI-registered analyst Deepak Pal.

While the stock is facing minor resistance near ₹3,900, the overall trend remains firmly upward, the analyst said. A sustained move above this resistance zone could lead the stock towards the ₹4,200 - ₹4,300 range in the short to medium term. This represents a 10% upside.

The analyst recommends accumulating around current levels or on dips, with a suggested stop loss at ₹3,600 to manage risk.

KEI’s fundamentals remain solid. It is a key player in the wires and cables space, serving sectors such as power, infrastructure, and real estate with a strong distribution network. In FY24, it posted over 20% growth in revenue, with margins around 11%.

The fundamental strength is backed by rising demand and low debt levels. Ongoing investments in capacity and R&D position the company well to capitalize on India’s infrastructure and electrification push.

Year-to-date, the stock has declined more than 12%.

For updates and corrections, email newsroom[at]stocktwits[dot]com.

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_1549425533_jpg_483afd6d69.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/unnamed_jpg_9dff551b50.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/large_stock_down_resized_901c19c371.jpg)

/filters:format(webp)https://news.stocktwits-cdn.com/Getty_Images_2235778544_jpg_2b7ceca102.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Aashika_Suresh_Profile_Picture_jpg_2acd6f446c.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/large_hawaiian_electric_resized_4b766fd741.jpg)

/filters:format(webp)https://news.stocktwits-cdn.com/jaiveer_jpg_280ad67f36.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/large_sealsq_stock_market_representative_resized_b05435011f.jpg)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2230137825_jpg_d14459f501.webp)