Advertisement|Remove ads.

KeySight Technologies Q1 Earnings Expected To Rise, Analysts Expect Cyclical Recovery In 2025: Retail’s Extremely Bullish

Shares of KeySight Technologies Inc. (KEYS) edged lower in after-market hours on Monday ahead of its first-quarter earnings. Still, retail investors and analysts are bullish on the company’s prospects.

KeySight is expected to post a rise in its earnings as well as revenue on a year-on-year (YoY) basis during Q1.

Wall Street estimates peg KeySight’s earnings per share (EPS) at $1.69 in Q1, rising from $1.59 a year ago. Its revenue is estimated at $1.28 billion, up from $1.26 billion it posted during the same period last year.

Data shows KeySight has beaten earnings and revenue estimates in the last four quarters.

Earlier in December, analysts at JPMorgan upgraded the KeySight stock to ‘Overweight’ from ‘Neutral.’ They also upped the price target to $200 from $170, implying an upside of over 15% from Monday’s closing price.

The brokerage underscored its bullish thesis, saying that it expects a broadening of KeySight’s growth drivers in 2025, fueled by a cyclical recovery in end-user demand.

It also said that KeySight’s acquisition of Spirent Communications, a UK-based provider of automated test and assurance solutions for networks, comes at a crucial time as KeySight gears up to take advantage of a demand recovery.

Analysts also think the Spirent acquisition will help KeySight deliver margin improvements in this fiscal year.

Of the 12 brokerage recommendations, FinChat data shows ‘Buy’ and ‘Outperform’ ratings stand at five each, while there are two ‘Underperform’ ratings.

The average price target is $180.43, marginally above the current price levels of the KeySight sight.

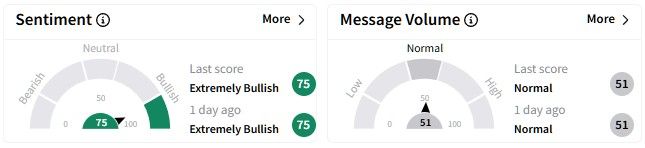

On Stocktwits, retail sentiment around KeySight stock was ‘extremely bullish’ (75/100) as investors prepared for the company’s Q1 results.

KeySight’s stock has been on an uptrend recently, gaining over 12% in the past six months and nearly 14% in the past year.

For updates and corrections, email newsroom[at]stocktwits[dot]com.

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2250240977_jpg_5b777d96ef.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/jaiveer_jpg_280ad67f36.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2206295220_jpg_1057588802.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/Rounak_Author_Image_7607005b05.png)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Trending_stock_resized_may_jpg_bc23339ae7.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/vivekkrishnanphotography_58_jpg_0e45f66a62.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2247614893_jpg_e1dcf2d2f6.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Aashika_Suresh_Profile_Picture_jpg_2acd6f446c.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Sound_Hound_jpg_7961ee756a.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/shivani_photo_jpg_dd6e01afa4.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2191702229_jpg_e9b50f268b.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/unnamed_jpg_9dff551b50.webp)