Advertisement|Remove ads.

Cleveland-Cliffs Stock Slumps On Q4 Miss As CEO Pins Blame On ‘Worst Steel Demand Since 2010’— Retail's Divided

Shares of Cleveland-Cliffs Inc. (CLF) sank over 4.5% in after-hours trading on Monday after the company’s fourth-quarter earnings missed Wall Street estimates by a notable margin.

Cleveland-Cliffs posted a loss per share of $0.68, higher than the estimated loss of $0.61 per share, ballooning from $0.05 a year earlier.

The Ohio-based company posted a revenue of $4.33 billion during the quarter, lower than the estimated $4.4 billion. On a year-on-year (YoY) basis, this is a decline of over 15%.

The company cited the fall in steel demand for its performance while noting that “too much imported steel from abroad… drove unsustainably low steel prices.”

“Our results in 2024 were a consequence of the worst steel demand environment since 2010 (ex-COVID). As a steel producer equipped to supply high-end steel -- like automotive exposed parts, among others -- we by design carry a higher fixed cost structure, and we are more impacted than others when markets are weak,” said Lourenco Goncalves, Cleveland-Cliffs' CEO.

A decline in domestic automotive production also impacted the company’s top line, but Goncalves expects Q4 to be the trough.

Throwing his weight behind President Donald Trump’s policies and tariffs on China, Mexico, and Canada, Goncalves said they would benefit the company.

Cleveland-Cliffs has missed four out of the past five quarterly earnings per share (EPS) estimates and all five revenue estimates.

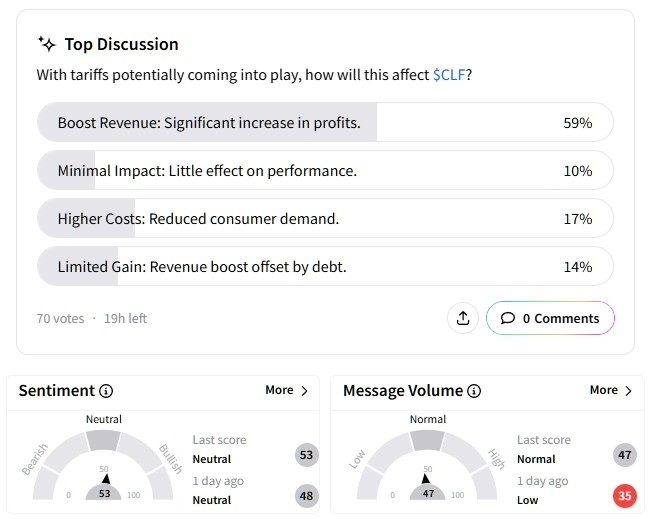

A Stocktwits poll showed 59% of the participants think that tariffs will boost revenue, while 10% think it will have a minimal impact. On the other hand, 17% users said this will result in higher costs and reduced demand, while 14% see limited gains.

Retail sentiment on Stocktwits around the Cleveland-Cliffs stock was divided, hovering in the ‘neutral’ (53/100) territory.

Cleveland-Cliffs’ share price has been going downhill recently, falling more than 19% in the past six months.

Its one-year performance has been worse, with the stock falling nearly 45%.

For updates and corrections, email newsroom[at]stocktwits[dot]com.

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2230137825_jpg_d14459f501.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Aashika_Suresh_Profile_Picture_jpg_2acd6f446c.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_anthropic_OG_jpg_51bd14bc5d.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Goldman_Sachs_resized_c6a47f630c.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/jaiveer_jpg_280ad67f36.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_tesla_cybertruck_jpg_7f6ed70b80.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/unnamed_jpg_9dff551b50.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Nebius_jpg_291bb409c7.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2202349941_jpg_3f45878d03.webp)