Advertisement|Remove ads.

Kimberly-Clark Sees 14% Watchlist Spike On Stocktwits After ‘Gutsy’ Kenvue Deal: Retail Optimistic

- Stocktwits watchers for Kimberly-Clark are up 14% over the last week, just after the company announced its $48.7 billion deal to buy Kenvue.

- The massive deal has investors concerned, in part due to material issues after the U.S. government’s view that Kenvue’s Tylenol pain reliever causes a higher risk of autism.

- Certain brokerages reduced their price targets following the announcement of the deal.

Retail traders are watching Kimberly-Clark closely after its $48.7 billion Kenvue acquisition. Over 500 users added the stock to their watchlists, following the company's announcement of a deal that has left the investor community divided.

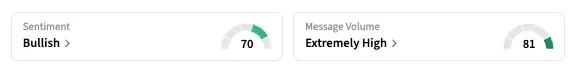

On Stocktwits, the watchlist count for KMB increased nearly 14% to 4,528, with the retail sentiment bouncing between ‘bullish’ and ‘extremely bullish’ over the week.

Deal Risks

The acquisition announcement, made last Monday, came as a surprise. Not only is the price tag steep (the offer is at a 45% premium to the Kenvue stock’s closing price on Oct. 31), but there are material concerns after the Donald Trump administration recently claimed that an ingredient in Kenvue’s Tylenol pain reliever causes a higher risk of autism when used during pregnancy.

Kimberly-Clark’s stock dropped 14.6% at the start of last week, recovering by a percentage point later. Kenvue’s shares rose 17.7% to $16.88 last week.

What Is Retail’s View?

The retail crowd on Stocktwits was trying to determine how to value the company, given its traditional status as one of the most defensive stocks in the consumer sector.

“I am in!” said one bullish user. “I’ll take that sweet dividend while I wait for this litigation bs to fade away. At 5%, I can be patient.”

“Cautiously positive but waiting dust settles?” remarked another, summarizing the viewpoints of the retail group. However, a few also openly criticised the Kenvue deal as a bad move.

Currently, 12 of the 18 analysts covering Kimberly-Clark Corp's shares have a ‘Hold’ rating, five rate it ‘Buy’ or higher, and one rates it ‘Sell,’ according to Koyfin. Their average price target of $128.63 implies a 24% upside to the stock’s last close.

A ‘Gutsy’ Move

A string of brokerages, including Morgan Stanley and Wells Fargo, have lowered their price targets on Kimberly-Clark’s shares in this time, while Evercore ISI downgraded the stock to ‘In Line’ from ‘Outperform.’

The Kenvue acquisition is "opportunistic and gutsy," said analysts at Evercore ISI, and makes Kimberly-Clark from a "low-risk restructuring and reorganization" story to one "with many moving pieces."

The combination does not suggest an attractive risk-reward trade-off at least up till 2028, they said.

There is also tremendous execution uncertainty, said analysts said Morgan Stanley, though it sees "the glass as more half full" on Kimberly-Clark's stock after the pullback. Wells Fargo analysts said the historic stock drop represents a material change in the investment case for the company.

Year-to-date, both KMB and KNVU stocks are down 20.8% as of their last close.

For updates and corrections, email newsroom[at]stocktwits[dot]com.

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2242061511_jpg_742d610600.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/vivekkrishnanphotography_58_jpg_0e45f66a62.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2164981884_1_jpg_100f5d0da3.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/shivani_photo_jpg_dd6e01afa4.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Getty_Images_2235778544_jpg_2b7ceca102.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/large_inflation_resized_f8af31ca5a.jpg)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/Rounak_Author_Image_7607005b05.png)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2203138957_jpg_dd735f9905.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_US_economy_representative_image_jpg_88c3aa4736.webp)