Advertisement|Remove ads.

KinderCare Stock Slips Premarket: Goldman Sachs Doles Out Downgrade On Growth, Occupancy Worries

Shares of KinderCare Learning Companies, Inc. fell about 2% in early premarket trading on Wednesday after a downgrade from Goldman Sachs.

Analyst George Tong downgraded the children's education and daycare chain's stock to 'Neutral' from 'Buy' and slashed its price target to $6 from $20, according to the investor note summary on The Fly.

The investment research firm believes that the stock's upside will be limited by the declining center occupancy rates and slowing revenue growth.

KinderCare's occupancy declines are due to local market dynamics rather than a single factor, making remediation efforts "likely complex and protracted in nature," according to Goldman Sachs.

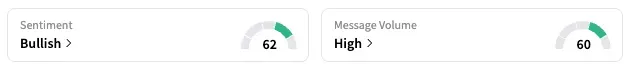

The downgrade comes as KinderCare has lost two-thirds of its stock market value this year. On Stocktwits, the retail sentiment for KLC was 'bullish,' up from 'neutral' two days ago, as the stock registered gains in the last two sessions.

Five of the eight analysts covering KinderCare have a 'Buy' or higher rating on the company's shares, and the rest rate it a 'Hold,' according to Koyfin data as of Tuesday. Their average price target of $12.25 implies an over 100% upside to the stock's last closing price.

For updates and corrections, email newsroom[at]stocktwits[dot]com.

/filters:format(webp)https://news.stocktwits-cdn.com/large_Circle_Internet_jpg_add0182c9c.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Anushka_Basu_make_me_smile_in_the_picture_b92832aa_af59_4141_aacc_4180d2241ba8_1_2_png_1086e0ed8c.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2263898051_jpg_9e75888009.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2262920033_jpg_f596c67fd3.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_1227710498_jpg_fbb12d04bf.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2233918556_jpg_1c5248e175.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2227669377_jpg_9a115c3623.webp)