Advertisement|Remove ads.

KKR Completes Second Tender Offer To Acquire Fujisoft In $4.4B Deal: Retail Sentiment Brightens

Private equity giant KKR said on Thursday it completed the second stage of its tender offer for Japanese system integration company Fujisoft and now owns nearly 58% of the firm, becoming its largest shareholder.

KKR received tenders in excess of 19.25%, the minimum ownership stake required to conduct a squeeze-out. The deal is valued at approximately $4.4 billion.

FK Co., an entity owned by investment funds managed by KKR, will hold a total of 35.75 million common shares and share options (758,400 shares on an as-converted basis) of Fujisoft once the second tender offer is settled.

The conclusion to Japan’s largest take-private deal this year comes after a lengthy bidding war between Bain Capital and KKR.

In early February, KKR decided to increase the offer price for the second tender offer to 9,850 yen per share ($65.62) from 9,451 yen apiece and also extended the period by seven days. The raise followed Bain Capital’s offer price of 9,600 yen per share.

Meanwhile, KKR said it aims to acquire the remaining shares of Fujisoft through a squeeze-out process, which will result in its investment entity owning 100% of the shares of the Japanese company. The Extraordinary General Meeting for the squeeze-out process is scheduled for late April 2025.

Hiro Hirano, Deputy Executive Chairman of KKR Asia Pacific and CEO of KKR Japan, said the fund is fully committed and looks forward to supporting Fujisoft’s plan to enhance its corporate value under new and simpler ownership by KKR following the privatization.

KKR’s tender offer will be financed predominantly from the KKR Asian Fund IV.

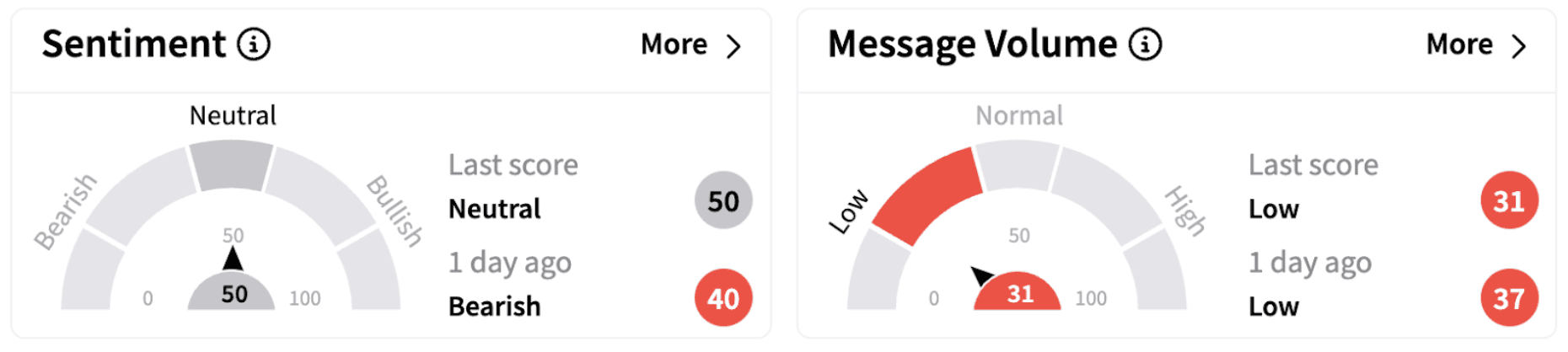

On Stocktwits, retail sentiment surrounding KKR climbed into the ‘neutral’ territory (50/100) from ‘bearish’ a day ago.

KKR has been in the news recently after it said it is set to acquire an additional 5% stake in Enilive from Eni for a consideration of €587.5 million ($614.75 million). The additional stake purchase will take KKR’s total holding in Enilive to 30%.

Enilive, Eni’s mobility transformation company, is involved in biorefining, biomethane production, smart mobility solutions, and providing services to support people on the move.

KKR shares have fallen nearly 8% in 2025 but have risen over 48% over the past year.

For updates and corrections, email newsroom[at]stocktwits[dot]com.

Exchange Rate: 1 Yen = $0.0067

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_1384896168_jpg_87fab3f04d.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Anushka_Basu_make_me_smile_in_the_picture_b92832aa_af59_4141_aacc_4180d2241ba8_1_2_png_1086e0ed8c.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2263571605_jpg_f769289486.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2233719278_jpg_46dfac21ee.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2263454468_jpg_23f4595a31.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2264020227_jpg_4d7420bef3.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2259210190_jpg_d48bbe3269.webp)