Advertisement|Remove ads.

Capital One Stock Rises After Bank Of America Upgrades Shares On DFS Acquisition: Retail Stays Bullish

Shares of Capital One Financial Corp (COF) rose over 2% on Wednesday after Bank of America upgraded the stock to ‘Buy’ from ‘Neutral’ while raising the price target to $235 from $207.

According to TheFly, Bank of America believes Capital One is well-positioned to benefit from the pending Discover Financial Services (DFS) acquisition, which should unlock near-term benefits and provide meaningful strategic and operational upside in the longer term.

The brokerage believes the combined company could earn mid-teens-plus returns on equity, which could also lead to a multiple expansion.

According to a CNBC report, Bank of America analyst Mihir Bhatia indicated that the acquisition would “fundamentally alter” Capital One’s standing in the payments space led by the access to Discover’s closed-loop network.

“A combination of Improving credit trends, pending acquisition-related revenue, and expense synergies as well as the potential for increased capital returns provide a cascade of catalysts that should excite investors and can provide near-term upside to Street estimates,” Bhatia said, according to the report.

In February 2024, Capital One announced its intent to acquire Discover in an all-stock transaction valued at $35.3 billion. The company stated then that Discover shareholders would receive 1.0192 Capital One shares for each Discover share.

Upon consummation of the deal, Capital One shareholders will own approximately 60% and Discover shareholders will own approximately 40% of the combined company, it had said.

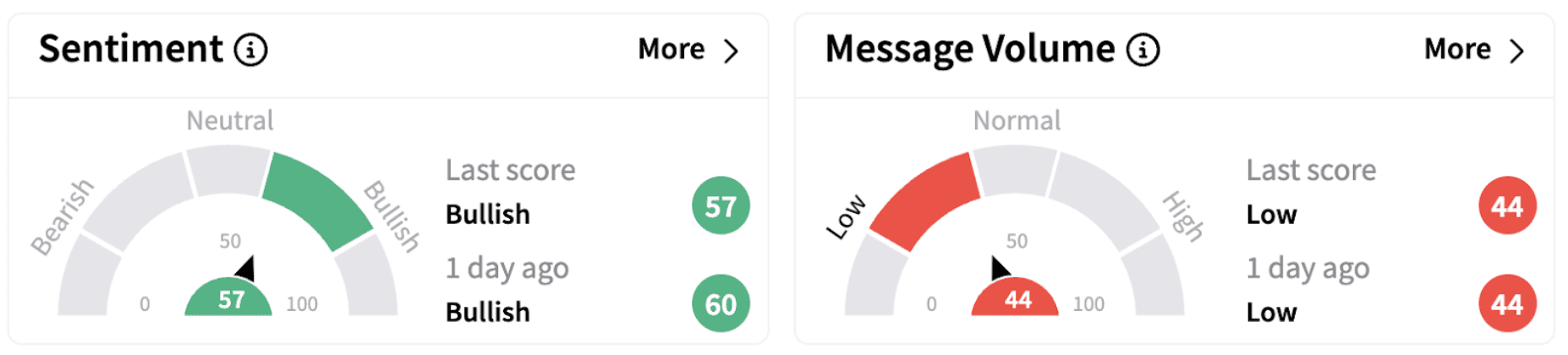

On Stocktwits, retail sentiment surrounding Capital One continued to trend in the ‘bullish’ territory (57/100) while sentiment trended in the ‘neutral’ zone for DFS.

Both COF and DFS shares have gained over 15% in 2025. Over the past year, COF has risen over 50%, while DFS has gained over 61%.

Also See: Nikola Stock Dives After Company Files For Chapter 11 Bankruptcy Protection: Retail’s Frustrated

For updates and corrections, email newsroom[at]stocktwits[dot]com.

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_912727778_jpg_3bd44c57ad.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Anushka_Basu_make_me_smile_in_the_picture_b92832aa_af59_4141_aacc_4180d2241ba8_1_2_png_1086e0ed8c.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_1235943608_jpg_91702ef0ab.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_167578473_jpg_29255f031f.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Michael_Burry_jpg_fa0de6ac92.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_winklevoss_1c7de389e0.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_altcoins_5a22b361ff.webp)