Advertisement|Remove ads.

KKR Stock In Spotlight After Report Of Potential $3B Deal For OSTTRA

KKR & Co. (KKR) stock garnered retail attention after a report said the private equity firm is nearing a deal to buy post-trade services firm OSTTRA for about $3 billion.

Bloomberg reported on Saturday, citing people familiar with the matter, that KKR is in advanced talks to acquire OSTTRA, a joint venture controlled by CME Group Inc. and S&P Global Inc., after edging out other suitors.

According to the report, the deal could be announced as early as next week.

Other buyout firms, Advent International, CVC Capital Partners and GTCR, were also in the running for a deal.

Takeover talks are ongoing and the deal could still be delayed or fall apart, Bloomberg reported citing the people.

Worries of recession amid tariff uncertainty have pushed private equity firms to accumulate large cash piles and be extra cautious in their approach towards deals.

Last week, KKR agreed to buy Karo Healthcare from Sweden’s EQT.

OSTTRA’s specialty lies in over-the-counter markets, where traders buy and sell away from a central exchange.

Last week, several brokerages trimmed the price target of KKR on doubts over capital markets recovery and lowered performance fee expectations due to fears of a worsening economy.

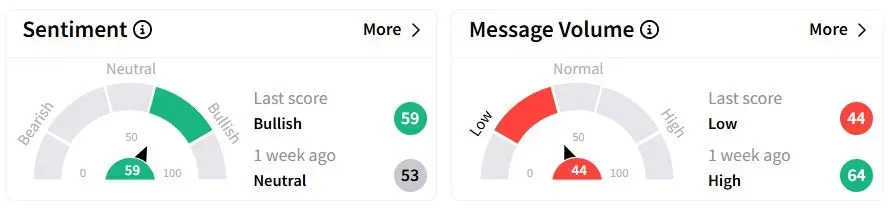

Retail sentiment on Stocktwits was in the ‘bullish’ (59/100) territory compared to ‘neutral’(53/100) a week ago, while retail chatter was ‘low.’

KKR shares have fallen 32.1% year-to-date (YTD).

Its shares rebounded last week after a sharp fall in the previous week after U.S. President Donald Trump declared a 90-day pause on the tariffs announced on April 2 for all countries except China.

Also See: Amazon Stock Snaps 9-Week Losing Streak: Retail Sentiment Jumps

For updates and corrections, email newsroom[at]stocktwits[dot]com.

/filters:format(webp)https://news.stocktwits-cdn.com/large_Trending_stock_resized_may_jpg_bc23339ae7.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/Rounak_Author_Image_7607005b05.png)

/filters:format(webp)https://news.stocktwits-cdn.com/large_bmnr_OG_jpg_83d4f3cc27.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/Prabhjote_DP_67623a9828.jpg)

/filters:format(webp)https://news.stocktwits-cdn.com/large_us_iran_jpg_753ef9f5af.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_capitol_market_OG_jpg_8111684a8f.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2222519332_jpg_15709268a8.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/IMG_9209_1_d9c1acde92.jpeg)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Plug_Power_jpg_08143c7fa0.webp)