Advertisement|Remove ads.

Kohl’s Stock Draws More Bears As Short Interest Climbs To 2-Month High: Retail Traders Stay Wary

- Short interest in Kohl’s shares rises to 31.1% from 24% in September.

- KSS declined last week, after rising for two straight weeks.

- Currently, more analysts recommend buying or holding the stock than those who advise selling.

Short interest for Kohl’s Corp.’s shares rose last week, according to data analytics firm Ortex, as reported by The Fly.

The figure had troughed at this year's lows of around 24% in the final week of September, a culmination of a near-tripling in the stock price from the lows seen in April.

Still, shares traded in a more sideways range over the past two months. Last week, shorts as a percentage of free float in the stock rose from 28.1% to 31.1%, the highest levels since mid-August, according to a report on The Fly.

KSS stock declined 0.7% over the last week, after two straight weeks of gains; it is up 16% year to date.

The department store chain is high on investors’ radar after it lifted its annual profit forecast and beat sales expectations for a second straight quarter in August. A mix of back-to-school purchases, more promotions, and fresh stock helped boost the business in the second quarter.

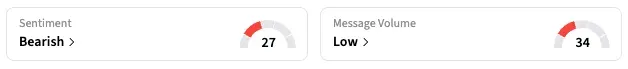

On Stocktwits, retail sentiment for KSS has remained in a ‘bearish’ zone since last week, though some users see it as a value opportunity.

“$KSS still one of the most undervalued stocks in the market,” said one user.

Currently, six of the 16 analysts covering Kohl’s have a ‘Sell’ or lower rating on the company’s stock, seven recommend ‘Hold,’ and three rate it ‘Buy’ or higher, according to Koyfin. Their average price target is $15.06, which is 7.4% below the stock’s last close.

Kohl's is scheduled to report its quarterly results on Nov. 25.

For updates and corrections, email newsroom[at]stocktwits[dot]com.

Read Next: Baidu's Robotaxi Fleet Now Matches Waymo's Pace As Weekly Ride Volumes Cross 250K

/filters:format(webp)https://news.stocktwits-cdn.com/large_trump_jpg_fc59d30bbe.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Aashika_Suresh_Profile_Picture_jpg_2acd6f446c.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_1190665957_jpg_92088206ed.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/jaiveer_jpg_280ad67f36.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2235337192_jpg_56c00409cf.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/unnamed_jpg_9dff551b50.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_marvell_logo_OG_jpg_dfc748dd9b.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2232147590_jpg_a31aecbfad.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2192591876_jpg_b8c2306674.webp)