Advertisement|Remove ads.

KPR Mill Faces Double Blow: US Tariffs And Technical Breakdown; SEBI RA Sees ₹1,020 As Next Target

KPR Mill shares fell nearly 3% on Thursday, mirroring the weakness across other Indian textile companies. This comes after US President Donald Trump announced a flat 25% import tariff on Indian goods, along with an added penalty for countries continuing crude trade with Russia.

India, being a major textile exporter, is directly in the line of fire, said SEBI-registered analyst Pradeep Carpenter.

Why KPR Mills Is Getting Affected

KPR Mills generates a significant portion of its revenue by exporting garments and yarn to the US. With the 25% tariff, Indian products become less competitive in the US market, leading to weaker demand and tighter margins.

Technical Outlook

Carpenter noted that the KPR Mill stock broke its key support zone around ₹1,160 on strong volumes, which is a clear sign of institutional exit. It is now trading below major moving averages, confirming a short-term downtrend.

He identified ₹1,110 and ₹1,080 as key support levels to watch. A breach below ₹1,080 could take it to ₹1,020. On the upside, any bounce will likely face supply near ₹1,165–₹1,175.

Other technical indicators, such as the Relative Strength Index (RSI) are slipping below 40, and Moving Average Convergence Divergence (MACD) has given a fresh bearish crossover, both showing continued weakness.

Overall, Carpenter said that the technical setup in KPR Mills is weak, and caution is advised.

He believes that in the short term (2–4 weeks), the stock is likely to stay under pressure unless there's some positive update on tariffs. Price may drift lower toward the ₹1,080–₹1,020 range in the absence of strong buying support.

Over the medium term (1–3 months), if the tariff pressure remains, we may see earnings downgrades due to pressure on export margins. He added that the company might explore new markets or operational efficiencies, but these are not overnight changes.

And in the long term (six months and beyond), investors may find value if macro conditions improve or tariffs are withdrawn.

Fundamentally, KPR Mills is a good company with strong execution. But till that clarity comes, expect volatility to continue, he concluded.

What Should Investors Do?

For traders, Carpenter said, avoid trying to catch the bottom right now and let the stock form a base. For investors, he suggested staying on the sidelines unless one has a long-term horizon and risk appetite.

For existing holders, ₹1,080 is a crucial level. If that breaks, investors can look at reducing exposure or booking partial profits.

What Is The Retail Mood?

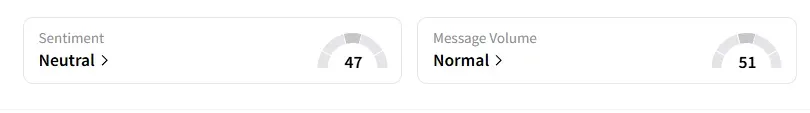

Data on Stocktwits shows that retail sentiment shifted from ‘bullish’ to ‘neutral’ a day ago on this counter.

KPR Mills shares have risen 15% year-to-date (YTD).

For updates and corrections, email newsroom[at]stocktwits[dot]com.

/filters:format(webp)https://news.stocktwits-cdn.com/large_immunitybio_jpg_eb6402d336.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/Rounak_Author_Image_7607005b05.png)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/large_credo_technology_resized_cdb4311141.jpg)

/filters:format(webp)https://news.stocktwits-cdn.com/shivani_photo_jpg_dd6e01afa4.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2228864541_jpg_d94770c5a8.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/vivekkrishnanphotography_58_jpg_0e45f66a62.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_joblessclaims_resized_jpg_b395b1ff15.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/large_cme_resized_5dbde36693.jpg)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Carvana_jpg_86121a5fd5.webp)