Advertisement|Remove ads.

Kroger Stock Trades In The Red As Q3 Revenue Falls Short of Estimates Despite Earnings Beat

- Kroger reported Q3 revenue of $33.9 billion, up 1% from the same period last year, missing analyst estimates of $34.2 billion.

- Adjusted earnings per share came in at $1.05, outperforming the $1.03 consensus.

- The company also revised its guidance for identical sales excluding fuel to 2.8% to 3%, down from the previous range of 2.7% to 3.4%.

The Kroger Co. (KR) shares traded lower on Thursday morning after the company reported its third-quarter 2025 results, with better-than-expected earnings but revenue missing estimates.

Total revenue for the quarter came in at $33.9 billion, up 1% compared to the same period last year. However, this was below analyst estimates of $34.2 billion. The company reported adjusted earnings per share (EPS) of $1.05, beating the $1.03 consensus.

"We continue to focus on what matters most – serving our customers, running great stores, and strengthening our core business. Our results show we are improving the customer experience and building a strong foundation for long-term growth," said Ron Sargent, Chairman and CEO of Kroger.

Spending Squeeze

The American retailer attributed its business momentum to growth in its e-commerce and pharmacy businesses. Kroger is among the many retailers that are betting big on online sales. “We have now completed our strategic review, which we expect will make our eCommerce business profitable in 2026,” said Sargent.

However, the supermarket brand has been under pressure from lowered consumer spending as well as the government shutdown that led to SNAP (Supplemental Nutrition Assistance Program) food-stamp benefits briefly expiring in November. On Wednesday, Macy’s CEO highlighted how customers remained cautious about spending.

Outlook And Sentiment

While Kroger's latest quarter identical sales excluding fuel rose 2.6%, the company revised its guidance for the same to between 2.8% and 3%, from the previous range of 2.7% and 3.4%. The company, however, increased the lower end of its guidance for the adjusted earnings per share to between $4.75 and $4.80 from the previous range of between $4.70 and $4.80.

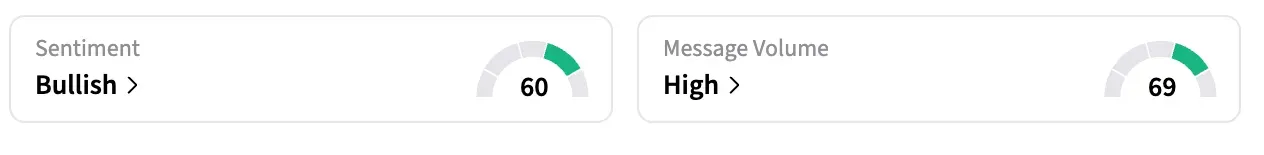

On Stocktwits, retail sentiment surrounding the stock remained ‘bullish’ while message volume jumped to ‘high’.

Kroger shares have gained over 10% in the past 12 months.

Also Read: Why Did TRAK Stock Rise 10% In Premarket Today?

For updates and corrections, email newsroom[at]stocktwits[dot]com.

/filters:format(webp)https://news.stocktwits-cdn.com/large_lucid_stock_jpg_167f2bc3dd.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/IMG_8805_JPG_6768aaedc3.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_So_Fi_new_6d7889a863.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/IMG_4530_jpeg_a09abb56e6.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/large_ibm_signage_resized_1a6adb0393.jpg)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/IMG_9209_1_d9c1acde92.jpeg)

/filters:format(webp)https://news.stocktwits-cdn.com/Getty_Images_2203832195_jpg_d80f13d1c7.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_patrick_soon_shiong_jpg_5f4d6bc18d.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2261740483_jpg_28cc9c7ce9.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/unnamed_jpg_9dff551b50.webp)