Advertisement|Remove ads.

Lam Research Stock Gains Ahead Of Q2 Earnings As Wall Street Expects 14% Revenue Upside: Retail Keeps Fingers Crossed

Lam Research Corp. (LRCX) shares climbed over 1% in morning trade Wednesday, ahead of its second-quarter earnings report, which is scheduled after the closing bell. Stocktwits retail traders are betting on an earnings beat, expecting shares to climb.

The stock benefited from broader strength in semiconductor shares following ASML’s earnings beat and strong 2025 outlook.

Wall Street expects Lam to report earnings per share (EPS) of $0.88 on revenue of $4.32 billion, a 14% increase from the prior year, according to Koyfin. This marks a reversal from last year's 28.8% decline recorded in the same quarter.

The company has a track record of outperforming expectations, beating revenue estimates for eight consecutive quarters.

Gross profit is projected to grow 13% year-over-year to $2 billion, with net income expected to reach $1.1 billion.

Investors will closely watch for management’s commentary on artificial intelligence (AI)-driven demand and future growth.

KeyBanc analyst Steve Barger upgraded Lam Research to ‘Overweight’ from ‘Sector Weight’ last week, setting a price target of $95, according to TheFly.

KeyBanc noted that while broader semiconductor industry trends remain uncertain, long-term investors may benefit from buying the stock ahead of an expected recovery in the second half of 2025.

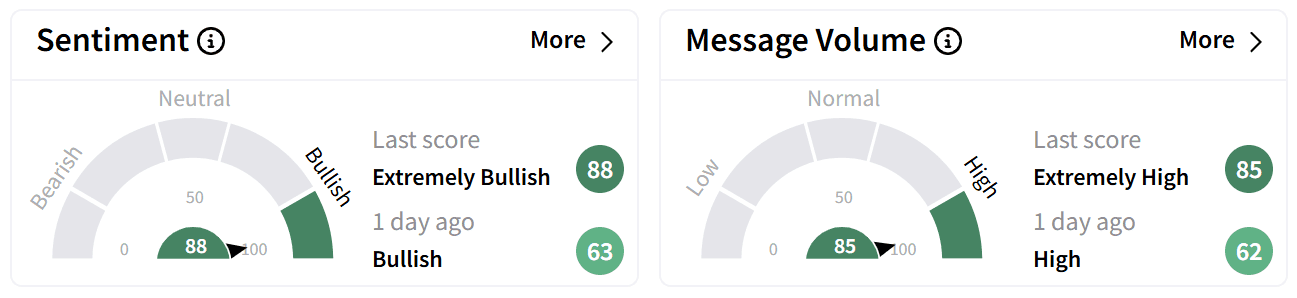

On Stocktwits, retail sentiment improved to ‘extremely bullish’ from ‘bullish’ a day ago as message volumes also increased to ‘extremely high’ from ‘high’ levels.

Investors on the platform largely expect the stock to rise post-earnings.

Peers like Texas Instruments (TXN) have seen revenue pressures within the broader semiconductor sector. TXN reported a 1.7% decline in revenue last quarter but surpassed analyst estimates by 3.5%.

Lam Research has outperformed its sector peers in recent weeks, rising 4.6% over the past month.

According to Koyfin, analysts currently have an average price target of $90.85 on the stock, implying a 17% upside.

For updates and corrections, email newsroom[at]stocktwits[dot]com.

Read also: IBM Stock Inches Up Ahead Of Q4 Earnings Despite Cautious Analyst Outlook: Retail Remains Uncertain

/filters:format(webp)https://news.stocktwits-cdn.com/large_Data_center_jpg_5f0fa8e828.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/IMG_4530_jpeg_a09abb56e6.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_bitcoin_OG_oct23_jpg_588046d0a9.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/Prabhjote_DP_67623a9828.jpg)

/filters:format(webp)https://news.stocktwits-cdn.com/large_nio_battery_swap_jpg_de98f34bea.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/IMG_8805_JPG_6768aaedc3.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_michael_saylor_strategy_2013_resized_jpg_e358c15fd4.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_1760545615_jpg_9507fd561a.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/IMG_9209_1_d9c1acde92.jpeg)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/large_trader_stock_chart_resized_861d098b1f.jpg)