Advertisement|Remove ads.

Laurus Labs Shares: SEBI RAs Divided On Outlook; Technicals Bullish, Fundamentals Worrying

Laurus Labs shares surged nearly 7% on Monday, hovering near its 52-week high.

In recent news triggers, the government of Andhra Pradesh allotted 531.77 acres of land in IP Rambilli Phase-II, Anakapalli district. The pharma company plans to set up Laurus Pharma Zone (LPZ), a manufacturing center, in this space.

SEBI-registered analyst Sameer Pande noted that on a daily timeframe, the stock is indicating a strong upside movement, supported by strong volumes and Relative Strength Index (RSI)around 88. Other technical indicators such as MACD, VWAP and others also suggest a strong positive movement.

On the monthly timeframe, Laurus Labs stock is showing a strong breakout pattern, trading above 100 and 200 day Exponential Moving Average (EMA), indicating a sustained uptrend.

Pande identified strong support around ₹850-₹830 levels,

Last week, Laurus Labs reported their earnings performance for the June quarter.

SEBI-registered Financial Independence rated it as a “ weak quarter” with sharp declines in both revenue and profit. They added that demand pressures from its Anti-Retroviral (ARV) division continue, though the Contract Development and Manufacturing Organization (CDMO) pipeline offers long-term potential.

Revenues fell 20% to ₹965 crore (YoY), impacted by weak ARV formulations and API business. While profits fell 80% to ₹33.4 crore, led by a lower operating leverage. Margins fell sharply to 15.8% vs 24.3% (YoY).

Financial Independence remains cautious in the near-term on the stock.

Meanwhile, post the earnings report, Goldman Sachs maintains a ‘Sell’ rating with a target price of ₹675, indicating 20% downside.

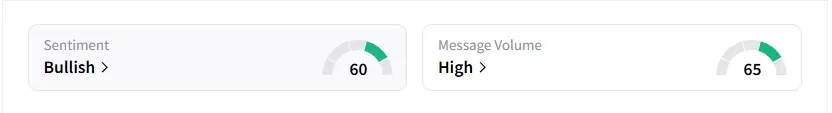

Data on Stocktwits shows that retail sentiment turned from ‘neutral’ to ‘bullish’ a day ago amid ‘high’ message volumes.

Laurus Labs shares have risen 48% year-to-date (YTD).

For updates and corrections, email newsroom[at]stocktwits[dot]com.

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/large_sealsq_stock_market_representative_resized_b05435011f.jpg)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/unnamed_jpg_9dff551b50.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Cybersecurity_jpg_bb1da91dbe.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Aashika_Suresh_Profile_Picture_jpg_2acd6f446c.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Vanda_jpg_943c16fa4f.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Getty_Images_2222341271_jpg_26b9066cf6.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2249860620_jpg_2bd9e54f08.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/jaiveer_jpg_280ad67f36.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2222819201_jpg_edcbb1336e.webp)