Advertisement|Remove ads.

US Election 2024: Short Bets Pile Up On Lucid, EVgo, SolarEdge, Sunnova As Bears Brace For Trump-Era Policy Shakeup

The aftermath of Donald Trump’s election victory has sparked a surge in short interest against several electric vehicle (EV) and renewable energy stocks.

Investors are preparing for potential policy changes that could reverse key green energy subsidies, leading to a wave of bearish bets on well-known names, in the five trading days to Nov. 7, according to data from Ortex reported by thefly.com.

Lucid Group, Inc. ($LCID)

Short interest in the EV-maker has skyrocketed from 19.6% to 65.2% — the highest on record. The days-to-cover ratio also increased from 10.9 to 11.9, reflecting a sharp rise in bearish sentiment despite heightened trading volume following Trump’s victory.

Lucid shares have already suffered in 2024, down nearly 50% year-to-date, further impacted by a mid-October equity raise that added to the selling pressure.

The political risk for the EV sector intensified after Tuesday’s election results, pushing Lucid to its lowest close of the year on Wednesday.

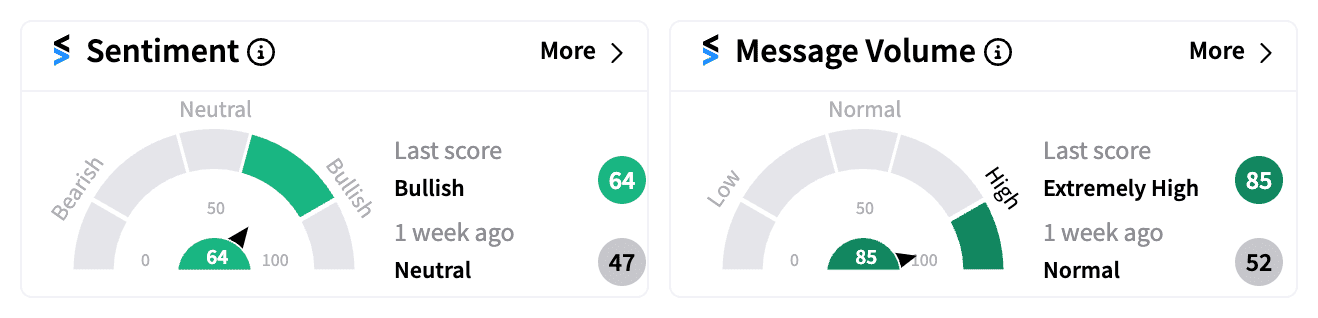

On Stocktwits, sentiment for $LCID remained surprisingly ‘bullish’ as of Friday’s close, even as the stock lost 1.56% over the past week, amid a 228% jump in message volume.

EVgo, Inc. ($EVGO)

Charging infrastructure company EVgo saw its short interest rise from 28.4% to 31.5%, the highest in three months, with days-to-cover extending from 4.0 to 5.1.

This surge comes despite early October gains fueled by sell-side upgrades and a Department of Energy loan guarantee to expand its public charging network.

The shift in sentiment highlights concerns that a Trump-led administration may pull back support for EV infrastructure.

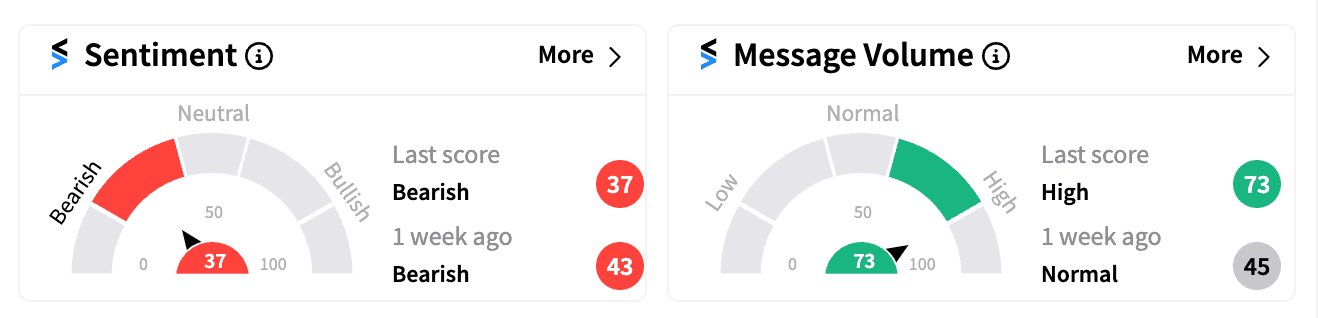

Shares of EVgo tumbled nearly 30% last week, with Stocktwits users turning ‘bearish’ at the close of trading on Friday. Message volume spiked by 300%.

Still, EVgo is up 55% year-to-date.

SolarEdge ($SEDG), Sunnova ($NOVA)

The solar sector has also been hit hard amid expectations of policy rollbacks on clean energy incentives.

Ortex data showed that short interest in SEDG rose from 30.5% to 32.4%, close to a one-month high, while NOVA saw an increase from 27.8% to 29.2%.

SolarEdge suffered a brutal week, losing nearly 25%, bringing its 2024 losses to over 85%, as analysts and investors worry about reduced support for solar technology.

Sunnova fared even worse, dropping over 46% last week alone, marking a near 80% decline year-to-date.

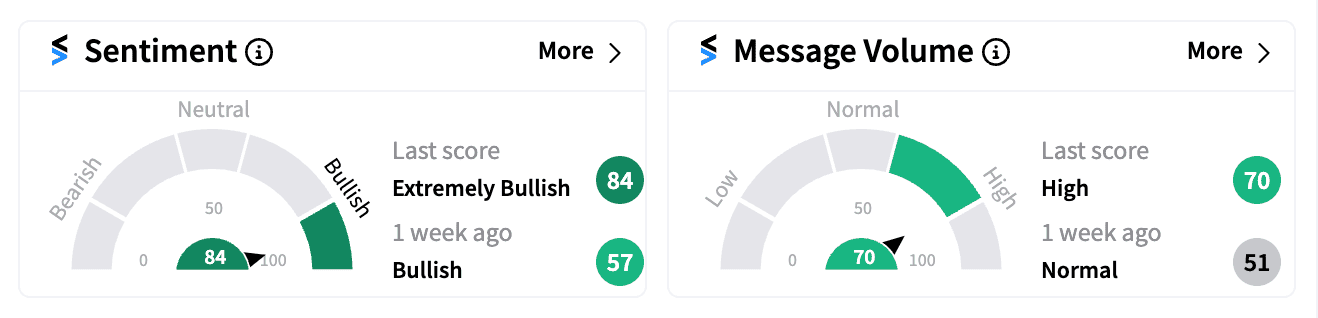

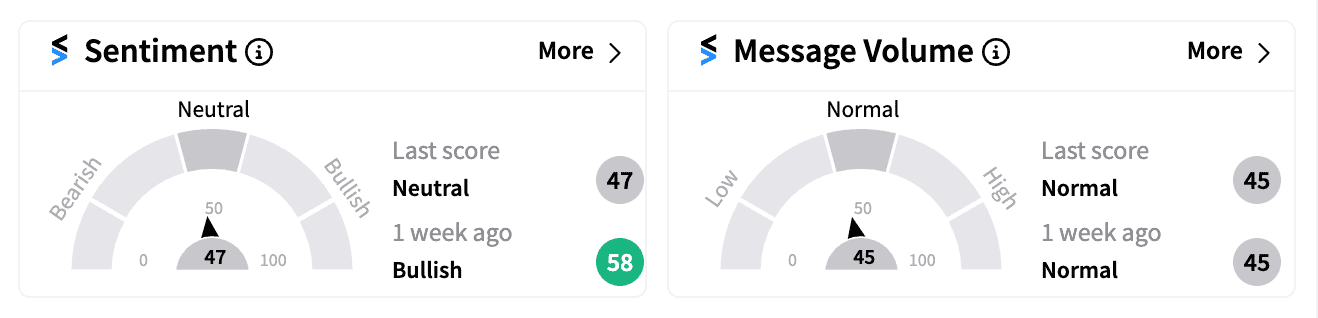

Despite this, Stocktwits users showed ‘extremely bullish’ sentiment for NOVA, as of Friday’s close, with weekly message volume soaring by over 3,000%, while SEDG sentiment remained in a ‘neutral’ zone with only a 4% increase in discussion.

For updates and corrections, email newsroom@stocktwits.com

/filters:format(webp)https://news.stocktwits-cdn.com/large_stock_chart_falling_resized_jpg_c0ce61eff2.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/Rounak_Author_Image_7607005b05.png)

/filters:format(webp)https://news.stocktwits-cdn.com/large_MSTR_caaa0be909.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Anushka_Basu_make_me_smile_in_the_picture_b92832aa_af59_4141_aacc_4180d2241ba8_1_2_png_1086e0ed8c.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_1903197985_jpg_2c45018acb.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/shivani_photo_jpg_dd6e01afa4.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Trending_stock_resized_may_jpg_bc23339ae7.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2203138957_jpg_dd735f9905.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/vivekkrishnanphotography_58_jpg_0e45f66a62.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_lumen_technologies_logo_resized_jpg_29f9980341.webp)