Advertisement|Remove ads.

Leidos Holdings Stock Rises Pre-Market On Upbeat Q4: Retail Stays Enthusiastic

Shares of Leidos Holdings Inc (LDOS) traded marginally in the green in Tuesday’s pre-market session after the company’s fourth-quarter earnings topped Wall Street estimates.

Revenue rose 10% year-over-year (YoY) to $4.37 billion compared to a Wall Street estimate of $4.13 billion, according to FinChat. This was driven by strong demand across all customer segments, especially for managed health services.

Earnings per share (EPS) came in at $2.37 versus an expected $2.28. Net income rose 23% YoY to $282 million during the quarter.

Leidos said net bookings totaled $7.6 billion in the fourth quarter and $23.4 billion for fiscal year 2024. The firm’s backlog rose 18% YoY to $43.6 billion.

For 2025, Leidos expects revenue at $16.9 billion-$17.3 billion compared to an analyst estimate of $16.97 billion. Non-GAAP Diluted EPS is expected at $10.35-$10.75 compared to a Wall Street estimate of $10.54.

CEO Tom Bell said the fourth quarter was especially strong in revenue growth and business development. “In addition, our 2024 performance propelled us beyond the three-year targets established at our 2021 Investor Day,” he said.

For the quarter, the company generated $299 million of net cash provided by operating activities and used $86 million in investing activities and $440 million in financing activities.

Meanwhile, the Leidos Board of Directors declared that the firm will pay a cash dividend of $0.40 per share on March 28, 2025, to stockholders of record at the close of business on March 14, 2025.

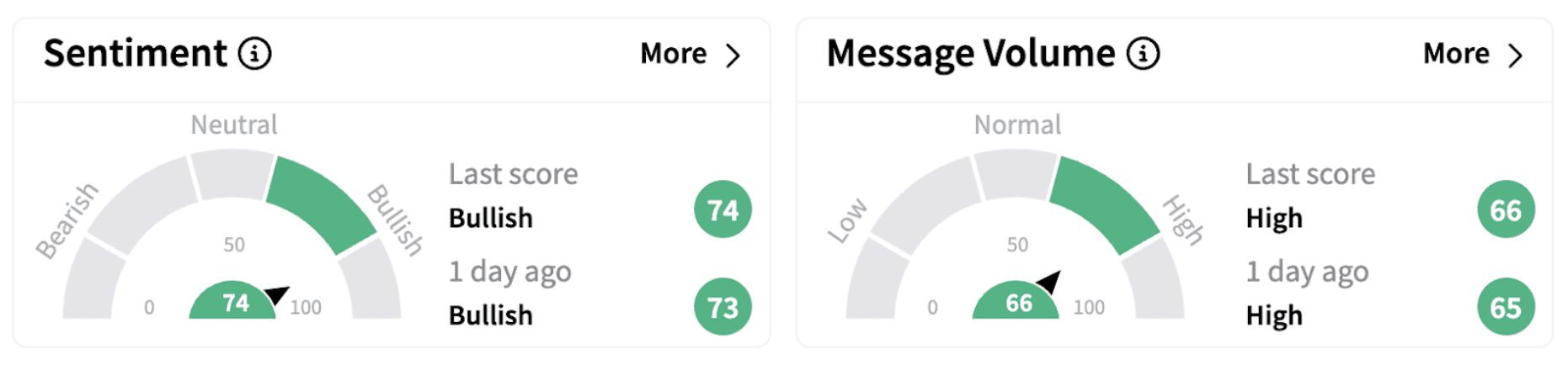

On Stocktwits, retail sentiment continued to trend in the ‘bullish’ territory (74/100) accompanied by ‘high’ retail chatter.

According to The Fly, Cantor Fitzgerald initiated coverage of Leidos with an ‘Overweight' rating and a $185 price target last week.

LDOS stock has lost 0.37% in 2025 but has risen over 24% over the past year.

For updates and corrections, email newsroom[at]stocktwits[dot]com.

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2199618807_jpg_0e9f26c6c5.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/jaiveer_jpg_280ad67f36.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2262651778_jpg_54075aa1d9.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Aashika_Suresh_Profile_Picture_jpg_2acd6f446c.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2246580703_jpg_9700e1e7e8.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/unnamed_jpg_9dff551b50.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2189643067_jpg_243b1172b6.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_1494564204_jpg_be6f667516.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2259256580_jpg_e72ea8ddc5.webp)