Advertisement|Remove ads.

LendingTree Stock Draws Analyst Praise Post Upbeat Q4 But Not Everyone’s Raised Price Targets: Retail Chatter Hits Year-High

Online lending marketplace LendingTree Inc. (TREE) attracted positive comments from analysts following its upbeat fourth-quarter earnings, but not everyone has raised their price targets on the shares. The stock closed over 22% higher on Thursday.

According to TheFly, JPMorgan analyst Melissa Wedel raised the firm's price target on LendingTree to $68 from $65 while keeping an ‘Overweight’ rating on the shares. JPMorgan noted that the fourth-quarter (Q4) "across-the-board beat versus estimates and guidance are undoubtedly positive.”

LendingTree reported a 95% rise in its total revenue to $261.5 million compared to a Wall Street estimate of $238.12 million. Adjusted earnings per share (EPS) came in at $1.16, significantly higher than an analyst estimate of $0.53. Net income, however, declined 41% year over year (YoY) to $7.5 million.

All segments witnessed significant growth during the quarter. Insurance segment revenue surged 188% YoY to $171.7 million, while Home segment revenue rose 35% to $34 million. Consumer segment revenue increased 12% to $55.6 million.

CFO Jason Bengel said the firm’s financial profile improved materially in 2024 with net leverage ending the year at 3.5x, a decline from 5.3x at year-end 2023.

“Our forecast anticipates further improvement in our leverage profile this year, which we intend to utilize to lower our cost of capital and improve free cash flow conversion for shareholders. We have also made steady progress managing the fixed costs of the business,” he said.

Despite the strong earnings results, two analysts slashed their price targets on the stock.

Needham lowered its price target on LendingTree to $65 from $78 while keeping a ‘Buy’ rating on the shares. The firm acknowledged the upbeat results but noted that its reduced price target reflects lower valuations for lead-gen stocks.

Similarly, Keefe Bruyette lowered its price target to $66 from $73 while keeping an ‘Outperform’ rating.

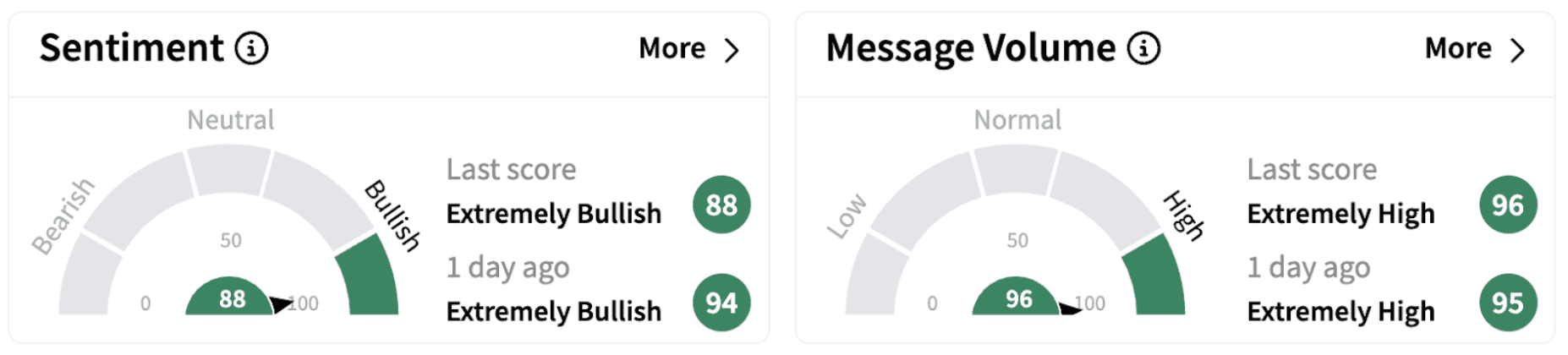

On Stocktwits, retail sentiment inched lower but continued to trend in the ‘extremely bullish’ territory (88/100). The move was accompanied by significant retail chatter that hit a year-high mark.

One user said an industry recovery could push the stock back to $90.

TREE shares have gained over 27% in 2025 and are up over 22% over the past year.

For updates and corrections, email newsroom[at]stocktwits[dot]com.

/filters:format(webp)https://news.stocktwits-cdn.com/Getty_Images_1247400381_jpg_765e6ec016.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/vivekkrishnanphotography_58_jpg_0e45f66a62.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Black_Rock_Bitcoin_ETF_IBIT_f66b744bfc.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Anushka_Basu_make_me_smile_in_the_picture_b92832aa_af59_4141_aacc_4180d2241ba8_1_2_png_1086e0ed8c.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_kraken_2091850a33.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_wall_street_resized1_jpg_7f200ce842.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/Rounak_Author_Image_7607005b05.png)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2215666275_jpg_07d03239b9.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/shivani_photo_jpg_dd6e01afa4.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_bitcoin_2026_2_jpg_a7bbca2bde.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/Prabhjote_DP_67623a9828.jpg)