Advertisement|Remove ads.

Leslie’s Stock Just Sank 25% And Retail Cannot Stop Talking About It: Here’s What Happened

Leslie’s Inc (LESL) shares tumbled nearly 25% during premarket trading on Tuesday, and retail user message count on Stocktwits jumped 880% over 24 hours after the pool and spa care products maker withdrew its fiscal 2025 forecasts on Monday evening.

CEO Jason McDonell stated that the company’s business faced significant challenges in its third quarter. “The extremely wet and unseasonably cooler temperatures across our top geographies disrupted peak pool season,” said

McDonell added that the unfavorable weather trends impacted traffic, as many customers delayed pool openings.

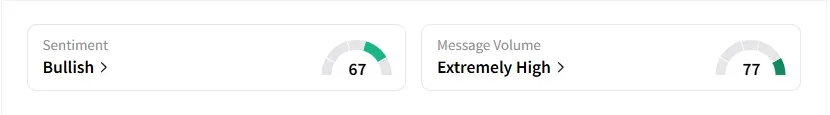

Retail sentiment on the stock dropped to ‘bullish’ from the ‘extremely bullish’ territory, with chatter at ‘extremely high’ levels, according to data from Stocktwits.

Leslie’s announced its preliminary third-quarter (Q3) results and said it expects net sales of about $500 million, a decline of about 12% versus the prior year quarter. The firm expects adjusted diluted earnings per share to come between $0.19 and $0.21.

Wall Street analysts are expecting Q3 sales to come in at $564.8 million and earnings per share to be $0.36, according to data compiled by Fiscal AI.

The company is expected to report earnings on August 6.

Telsey Advisory Group cut its price target on Leslie to $0.75 from $1.25 and maintained a ‘Market Perform’ rating.

“The company's results were also likely pressured by a difficult macro environment, especially in large-ticket discretionary categories, given ongoing uncertainty related to tariffs and fiscal policies,” Telsey Advisory Group analyst Dana Telsey said.

She added that the brokerage remains on the sidelines, as Leslie's shows no clear sign of a return to positive sales growth in the near term.

A bullish user on Stocktwits stated that at current levels, it’s “a very lucrative buyout candidate.”

Shares of Leslie were trading at $0.49 and are down more than 70% so far this year.

For updates and corrections, email newsroom[at]stocktwits[dot]com.

Also See: UPS Q2 Earnings Preview: Demand Trends, Cost-Cutting Efforts In Focus

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2194650023_jpg_2af2244b5a.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Aashika_Suresh_Profile_Picture_jpg_2acd6f446c.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2227669423_jpg_f410427536.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/unnamed_jpg_9dff551b50.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_cathie_wood_OG_2_jpg_c5be4c4636.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Getty_Images_2233055049_jpg_0a316df698.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/jaiveer_jpg_280ad67f36.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2228864541_jpg_d94770c5a8.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/vivekkrishnanphotography_58_jpg_0e45f66a62.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Sandisk_jpg_920fcc1fc3.webp)