Advertisement|Remove ads.

UPS Q2 Earnings Preview: Demand Trends, Cost-Cutting Efforts In Focus

United Parcel Service (UPS) stock has gained 2.2% over the past week ahead of its quarterly earnings report on Tuesday.

According to Fiscal.ai data, Wall Street expects the parcel delivery firm to post earnings of $1.57 per share on revenue $20.85 billion for the second quarter. UPS has topped earnings estimates in three of the previous four quarters.

UPS and its peer, FedEx, are considered bellwethers for the U.S. economy, as they cater to a wide range of industries. The company’s second-quarter earnings would give a hint at the impact of President Donald Trump’s tariffs, which severely disrupted the logistics business in April.

FedEx executives said last month that shipments from China experienced a significant decline in May. UPS is also facing stiff competition from Amazon in the U.S., amid rising costs.

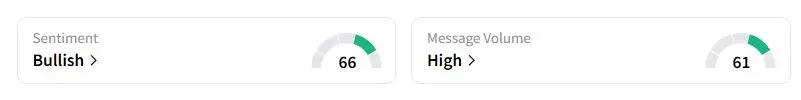

Retail sentiment on Stocktwits about UPS was still in the ‘bullish’ territory at the time of writing.

To rein in costs, the company aims to reduce its workforce by approximately 20,000 positions this year and close 73 leased and owned buildings by year-end. The parcel giant anticipates $3.5 billion in total cost savings from the measures, along with $400 million to $600 million in expenses related to early asset retirements, lease-related costs, third-party consulting fees, and employee separation benefits.

According to The Fly, UBS analysts noted earlier in July that despite a noisy macroeconomic backdrop in the second quarter, trends in UPS's domestic package business remain consistent with the framework UPS previously laid out.

“This will beat and guide up. $100 is a big mental level. It's beat up, should go up on any good news,” one retail trader said before adding that the Republican tax and spending bill will also likely help the company.

Economic uncertainty has also eased in the past few weeks as the U.S. has struck several important trade agreements with key partners, including Japan and the EU.

UPS stock has fallen 20% this year.

For updates and corrections, email newsroom[at]stocktwits[dot]com.

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_1236199359_jpg_28b0018e3a.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/IMG_9209_1_d9c1acde92.jpeg)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2199401088_jpg_656c1eacd4.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/IMG_4530_jpeg_a09abb56e6.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/large_wall_street_sign_resized_f75f6c0a63.jpg)

/filters:format(webp)https://news.stocktwits-cdn.com/IMG_8805_JPG_6768aaedc3.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_tesla_fsd_jpg_e90331e6a6.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/unnamed_jpg_9dff551b50.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2210921290_jpg_46bb1e6211.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_figma_original_jpg_90603f536b.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Aashika_Suresh_Profile_Picture_jpg_2acd6f446c.webp)